August 2022 Newsletter

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

MARKET UPDATE

Since our last newsletter things in the California marketplace have definitely pivoted. The residential market has returned to a more normalized, sustainable trends where buyers and sellers are actually negotiating prices and deal points. Not too many stories of sellers receiving multiple offers and going with the one that is $150,000 over asking. As mortgage rates creep up (which is not necessarily a bad thing) affordability of a monthly housing payment has chopped down the hyper appreciation of homes that California experienced the past 24 months. It appears we are settling into a more traditional housing market for SFRs for the remainder of 2022 and through 2023.

Now on the multi-family residential front we continue to see strong demand from virtually every landlord who is scrambling to add to their portfolio of properties. Rents are still on the rise in California as our housing shortage is exasperated by the lack of new homes being built. Half of all landlords raised their rents last year alone by 10% of more! The demand from our landlord clients at this time is unprecedented. This means the Fund is able to cherry pick the best-of-the-best to fund new trust deeds. We expect this trend to continue for the foreseeable future. While the commercial and industrial market for Coastal Capital is not a large portion of our portfolio we are seeing strong deal flow in industrial manufacturing and retail and as expected commercial office space continues to struggle.

Now many of you have asked if the real estate bubble has popped? We believe that unfortunately it has not (remember the fund’s returns are historically inverse and our best years were 2009 & 2010) because its completely different this time around. During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. The graph below showcases data on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA). The higher the number, the easier it is to get a mortgage.

Running up to 2008, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices.

Source: Mortgage Bankers Association

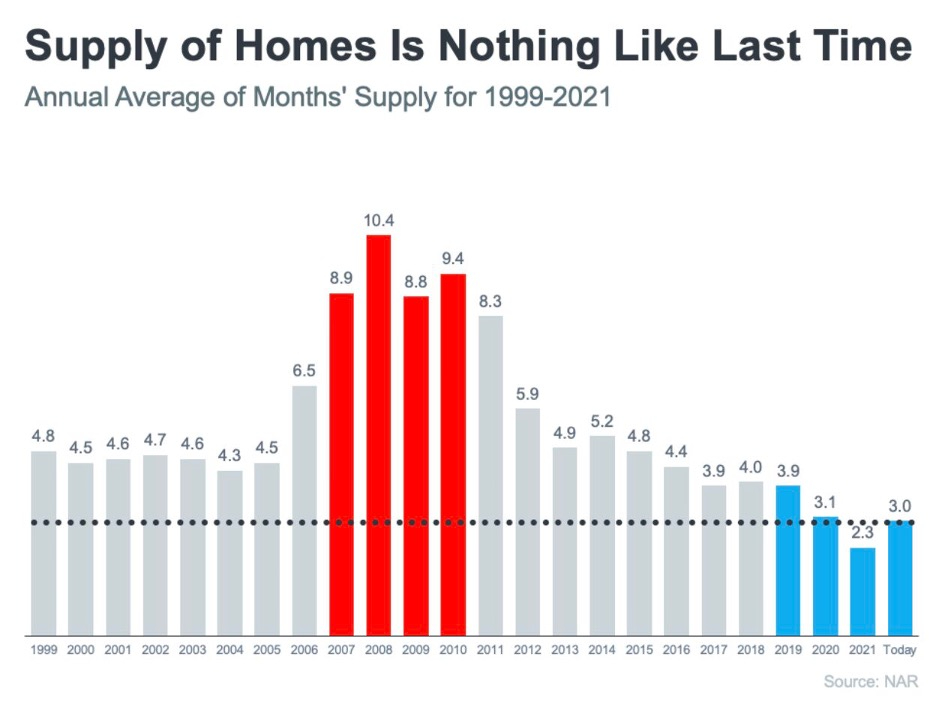

Today, things are different, and purchasers face much higher standards from mortgage companies. In our opinion traditional mortgage standards are tightening recently due to increasing economic uncertainty. The second factor is the supply of housing continues to be below three-months in California. The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation.

For historical context, there were too many homes for sale during the housing crisis of the 2000s (many of which were short sales and foreclosures), and that caused prices to tumble. Today, supply is growing, but there’s still a shortage of inventory available.

Source: National Association of Realtors

As mentioned above, our deal flow is at an all time high. Long term real estate investors continue to make up most of our applications to acquire new properties and remodel existing rental units in their portfolios. Small business owners leveraging their personal properties are also out in droves searching for financing. Big banks are once again leaving even their best small business clients high and dry, just take a look at our Highlighted Portfolio property! With such good deal flow we were created just under 3% return for investors in the second quarter of 2022 and improved July’s returns. As the stock market tanks we are happy as fund managers that most of you have been adding to your investment in Coastal Capital. Especially now we are welcoming new partners to join the fund (minimum initial investment for new investors is $100,000.)

PORTFOLIO HIGHLIGHT

This month’s highlight was one of the easiest deals to underwrite and close with a 10% loan-to-value ratio. The family needed a quick cash infusion for their business to take advantage of some steep discounts being offered by their suppliers if they pre-paid for inventory. Now we are not the least expensive source for accessing home equity however we are known in our broker network for moving fast & actually closing! We love working with clients and their brokers who are on it and respond quickly to get a deal done.

Three days later we were able to wire funds so this family business could purchase the inventory to drastically increase their future bottom-line revenue. Our borrower was ecstatic on the speed of the closing. After their busy holiday season, they expect to pay us off early. Think we have a client who will return next year, and the next year, and…

- SFR 3 BED / 3 BATH

- Claremont, CA

- Position: 1st TD

- Rate: 12.99%

- CLTV: 10%

- Appraised Value: $1,300,000

Please visit our blog section of the website for the latest updates

and check out each loan origination.

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend to provide some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $25,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713