Coastal Capital Quarterly Summary – Performance Recap Q1 2023

No matter what your long-term financial goals are, making smart investments along the way can be a major factor in your success. Portfolio diversification is a highly recommended investment strategy that you should consider if you’re serious about investing.

Without it you can lose large chunks of your portfolio with a downside move by one asset. If all you own is Tesla stock, you’ve seen it go up fast and also down very fast! Great for rollercoasters but not your wealth.

Portfolio diversification is essentially the act of choosing different types of investments that don’t have the same historical performance. To do this, people typically invest in different types of assets, such as:

Strategic asset allocation allows you to build a portfolio that is more resilient than one made up of just one asset class. Even when one asset is in decline, a balanced portfolio has a better chance of generating overall returns.

It’s also important to think about the liquidity of your investments. For example, private loans, notes and trust deeds are a safe, relatively liquid, and stable investments. In addition, they provide good yields, whereas the liquidity and value of hard assets depend on their value at any given moment.

Markets of all types fluctuate but not always in the same way. Having a mix of assets and assete types helps protect you when one market swings. When you don’t diversify, you have all of your proverbial eggs in one basket. Although many markets go through cycles, and you may be able to wait out a down period, the possibility of losing your investment is always a reality, especially if all of your investments are in the same asset class.

By diversifying your portfolio to include a mix of assets such as private notes, stocks, and real estate, you get the potential benefits of managing risk and stabilizing returns. Study after study has proven that for long-term wealth generating investments a sensible mix of income real estate investments (such as Coastal Capital), equities sprinkled with a few alternative investments (art, angel investing, crypto) almost always generates above average returns with less inherent risk

Portfolio diversification allows you to choose a variety of investments that match your risk tolerance. When you have investments in multiple types of assets, you maintain the possibility of generating returns, even when one or more markets are in decline. Having a combination of high-risk assets, such as cryptocurrency, balanced with assets such as private loans, which typically deliver more stabilized returns, allows you to balance risk.

Putting all of your investments into high-risk assets such as cryptocurrency or trading options can provide you the largest gains; however, there are no guarantees. A diverse portfolio may have the potential to perform better than if you were investing in just one asset class, especially in the long term. You can also choose assets that tend to have more predictable returns. For example, because private loans generate income from the interest on the loans, the returns tend to be more stable.

When strategizing, it’s important to keep a few things in mind. Investing is a dynamic activity, and you can’t just set your diversification strategy and forget it. Follow these tips when diversifying your portfolio.

Different types of asset classes come with different levels of risk. Understand the nuances of each type of asset you’re considering and how much of your portfolio they should account for.

Investing preferences change over time. You might be more or less risk-tolerant than you were when you made your initial investments. Your financial situation might also change with a new salary or a windfall. Take a look at your portfolio at least once a year to determine if your asset mix stills feel right for your goals. Make adjustments as needed and repeat the process on a regular basis.

If you invest in the stock market, diversify with a mix of stocks and bonds with different market capitalizations. With your real estate investments, maintain a mix of residential and commercial properties. You can also diversify geographically to protect yourself against local fluctuations. The more diversity you have, the more safety you have built to protect your financial future

Here at Coastal Capital fund we partner with investors to generate above average returns (13% annually on average since inception) safely secured by real estate by pooling all our partners capital to be diversified in over 100 private notes (aka trust deeds.). Many of our partners choose to allocate 20 to 40% of their portfolio to the fund and it serves as a great baseline. If you need assistance in diversifying your portfolio please visit us at https://www.coastalcapital.com/investors/ for more info or give us a call.

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

Mortgage rates are holding steady around 6.5% to 7% for conventional financing. The market has definitely priced in the Federal Reserve’s recent rate hikes and most likely at least one future hike. As mentioned before the average mortgage rate over the past 35 years has been 7.5%, so we truly are returning back to baseline. It appears that the loose monetary party is over for now and the hangover the next morning isn’t too bad. Guess we all learned some valuable lessons from the financial crisis of 2008/2009.

The Mortgage Bankers Association recently released their forecast for 2023. They are expecting a slow drop to 5.2% by the end of the year which continues in 2024 to the 4.5% range. Their reasoning is that economic growth rate will slow down some as the Federal Reserve tightens up. This will send investors scrambling back into the safety of government bonds. We all know that this demand will boost bond prices and lead to lower yields which will bring down the prime rate. As Fund managers we are not completely on board with this forecast but do think mortgage rates will remain pretty steady and in line with historical norms for near- and mid-term future languishing around six percent into 2024 with the occasional dip into the upper-five percent range.

Now for most of our California markets the lack of inventory continues to write the story (except for San Francisco and the Bay-area which are down 5 to 10 percent with the combination of tech layoffs & homeless issues.) Homeowners are only listing their homes if they must sell! In high-end markets where working professionals tend to move for employment the levels are even lower. These homeowners have locked in super low rates and are choosing to rent out their homes for $10,000+ a month rather than sell. This way they have a property to return to later and are enjoying significant cash flow. The National data is also telling the same story.

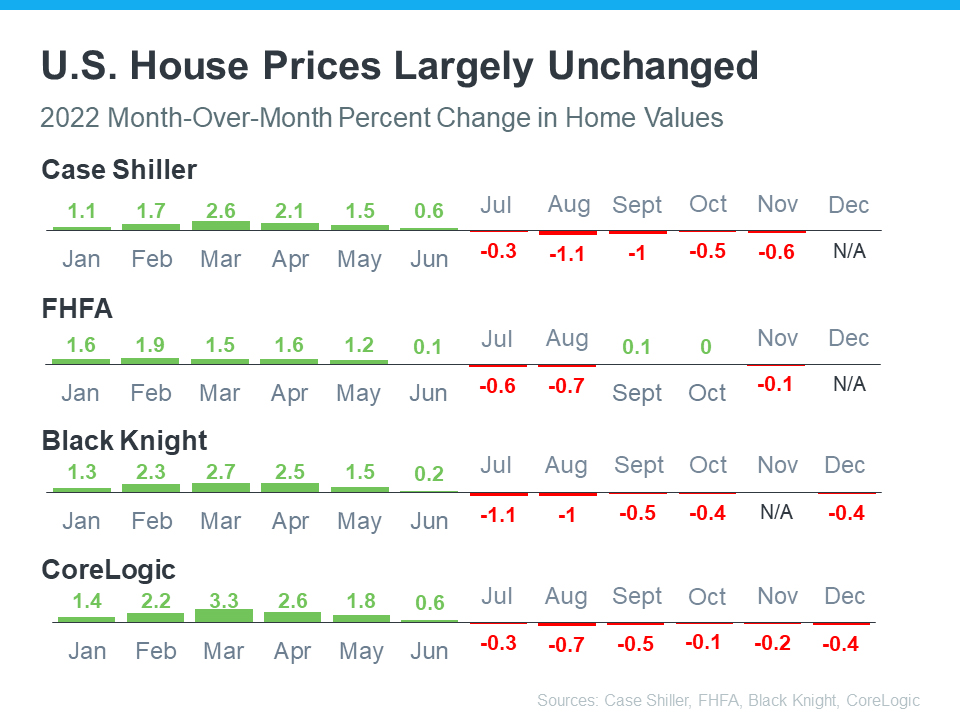

The chart below summarizes data points from CoreLogic, Black Knight, Case Shiller & the Federal Housing Finance Agency. Month-over-month home price changes are holding relatively steady. Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), says:

“U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.”

Sources: Case Shiller, FHFA, Black Knight, CoreLogic

The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. Local price trends still vary by market, but here in California we’re experiencing even less depreciation.

It is going to be an interesting Spring selling season for realtors as the inventory shortage is expected to continue indefinitely. New building starts continue to be depressed with the annual rate of total housing starts falling 21.8% from the previous year in the fourth quarter of 2022. This combined with the fact that new listings are down roughly 20% from the previous year is spelling bad news for the upcoming selling season. Let’s not forget that 40% of annual home sales for the year happen in the Spring. It is going to be a tough year for all our realtor friends.

Multi-family residential income continues to drive the returns of the portfolio and make up the majority of our trust deeds. Rental rates have definitely slowed down in their astronomical increases experienced last year; however they are not anywhere to close decreasing. The Fund’s clientele of landlord investors continues to flood our application desk with new requests for financing as they either seek to quickly snap up opportunities or are renovating existing assets to maximize cashflow.

Conventional banks are really starting to tighten up according to our small business clientele. We are constantly hearing stories from business owners with multi-decade banking relationships being shut down when applying for credit lines, factoring and even equipment financing applications (which are secured by the physical equipment!). Many of these borrowers have solid cash flow and near prime credit. As a result, our loan application desk is seeing a big uptick in volume. Lots of solid deals out there at above average rates. If you follow our social channels, you have probably noticed a majority of yields being originated at a 13.99% rate. Given all the above as Fund Managers we are very bullish on 2023 and our success will only be constrained by our access to lending capital.

The Fund continues to grow from a strong mix of new and existing partners. Please let us know if a family member or friend wants to join us in 2023. Initial investment amount still requires $100,000 and existing partners in the Fund can add on in any amount of $2,500 or more.

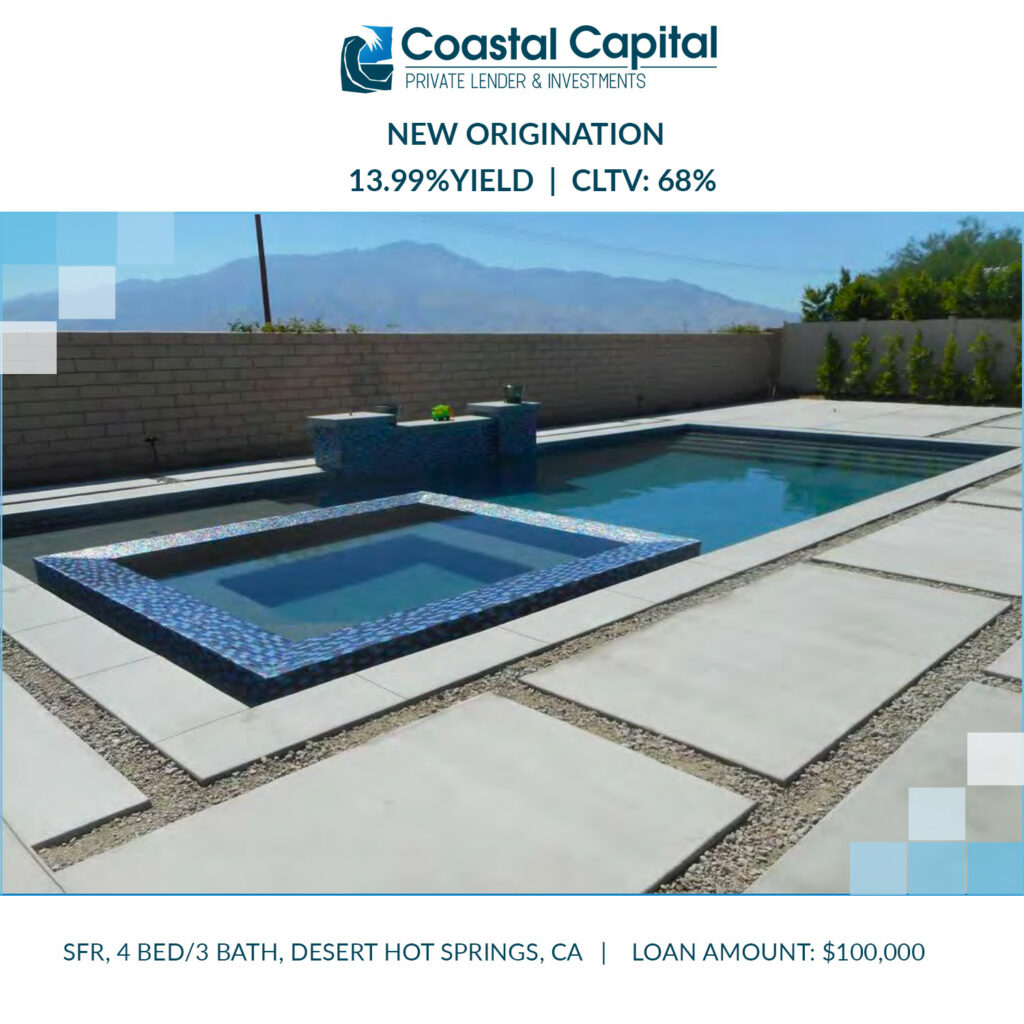

This borrower has turned to Coastal Capital numerous times while building a great portfolio of vacation rentals in Palm Desert-area. He finds gems in the desert and then remodels them with great outdoor spaces, epic pools, games galore (bocci ball courts, horseshoe pits, putting greens, etc.) and of course outdoor kitchens with bars. Then he turns on his “cash money machines” as he calls it! We call them the AirBnB and Vacation Rental By Owner (VRBO) platforms.

With this property we were able to fund in a week so he could get pool contractors out the following week. Given his track record and beautiful remodels we considered this one a trophy property and pushed the loan-to-value to 68%. Now he’s got this property fully rented out for the entire 2023 high season!

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713

As with all types of investing, passive income strategies come with tradeoffs. Consider the degree of control, time investment, risk, and your desired monthly income. Control means how much of the investment is under your control versus what you leave to others. Time investment means how much of your time you must dedicate toward the investment. Risk speaks to the degree of risk you are willing to accept. And if you have a monthly income target, it may preclude certain types of investments.

Think about how much time and money you’re willing to invest to generate passive income. For example, marketing a product requires a large amount of up-front work, sales tax maintenance, ongoing marketing costs, and significant human capital. Managing a rental property often requires an up-front investment for upgrades and repairs, tenant interactions, building upkeep, and ongoing maintenance costs. Short-term rentals come with wear and tear on the property and ongoing costs and efforts of cleaning and turnover.

With mortgage fund investing, the fund does the work to vet borrowers, and the borrowers do all the work. You make money on the interest with steady monthly or quarterly payments that require no effort on your part. However, for some investors this may be a drawback as they enjoy diving into the details and knowing the borrowers.

Do you need your passive income to be predictable? Do you depend on having a minimum income from this source? What happens if your rental property sits vacant for a few months? If you invest in rental properties, having cash reserves is essential for handling the unexpected.

What if you invest in a company that goes bust? When investing in a business, not participating in day-to-day management means you have little or no influence on its success. Your income depends on the business being profitable, so think about how that aligns with your risk profile.

Think about how liquid you would like your investments to be. Can you take funds out if you need to, or are they locked up for a certain amount of time?

Earned income from passive sources is taxable—in some cases, even if you don’t take the income and reinvest. Consider this when deciding which path is right for you. Is the effort worth the amount you get to keep? Depending on the type of investments you make, earnings could be taxed as passive income or portfolio income. Work with a professional to determine the best passive income tax strategies for your situation.

When you invest in mortgage funds, you get consistent monthly (Coastal Capital is monthly) or quarterly distributions based on the interest payments generated from loans. Due diligence is critical, so do your homework on the Fund, their track record, and the risk they are taking. Look for a sponsor that has seasoned underwriters and a risk profile that aligns with yours, a long track record, reputable references, and consistent performance.

Check with the sponsor about the lockup and liquidity rules. How long is the lockup: 1 year, 3 years, 5 years? What is the process for redeeming? Is there a limit or gate to when and how much you can draw down? It’s important to understand the investor requirements before jumping in with both feet.

Coastal Capital has been serving investors since 2007 with a strong collection rate and competitive investor yields.

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

Charging into 2023 we didn’t expect conventional mortgage rates to settle and now we’re back in the low-6% range. This seems to have given some relief in the single-family residence market and spurred a few homebuyers. With the Federal Reserve still poised to raise rates later this week 0.25% this is possibly setting up to be just a temporary reprieve. The Mortgage Bankers Association index for new mortgage applications made big gains during the month. Refinance applications to conventional lenders were up over 15% the second half of the month as compared to the second week of January. Although not an apples-to-apples comparison, here at Coastal Capital we also experienced incredible application volume from our brokers for our business purpose trust deeds.

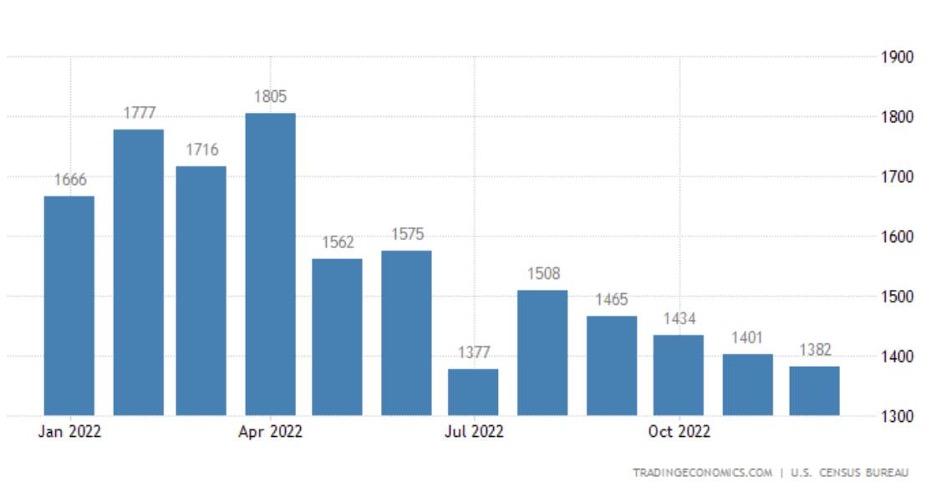

The California market still has the same issue for both the residential and multi-family markets: Supply! Current owners still have little interest in moving and graduating up to an interest rate that is almost double last years (80% of them locked in at 3.5% or less.) Now to exasperate matters, new builders are delaying new projects as the cost and availability of raw materials is highly questionable. Construction on new U.S. homes fell a seasonally adjusted 1.4% in December to 1.38 million, the Commerce Department said last Thursday. The drop in construction on homes followed the decline in November, when housing starts also fell by 1.8%. In fact, housing starts are at the lowest level since July 2022. The annual rate of total housing starts fell from 21.8% from the previous year. The chart below from the US Commerce Department while not to scale highlights the drop off.

Source: US New Housing Starts in Units, Trading Economics

Another story that hasn’t changed is sky high residential rents. For the residential markets in California the home affordability index that was already at historic lows keeps getting worse. With limited housing supply outlined above we don’t see this trend changing anytime soon. The average rent for a 3 bedroom single family home in Los Angeles has now eclipsed $5,000 per month. Soon the cost of renting will spur non-homeowners to settle on a property and purchase it to reap the tax advantages of paying mortgage interest.

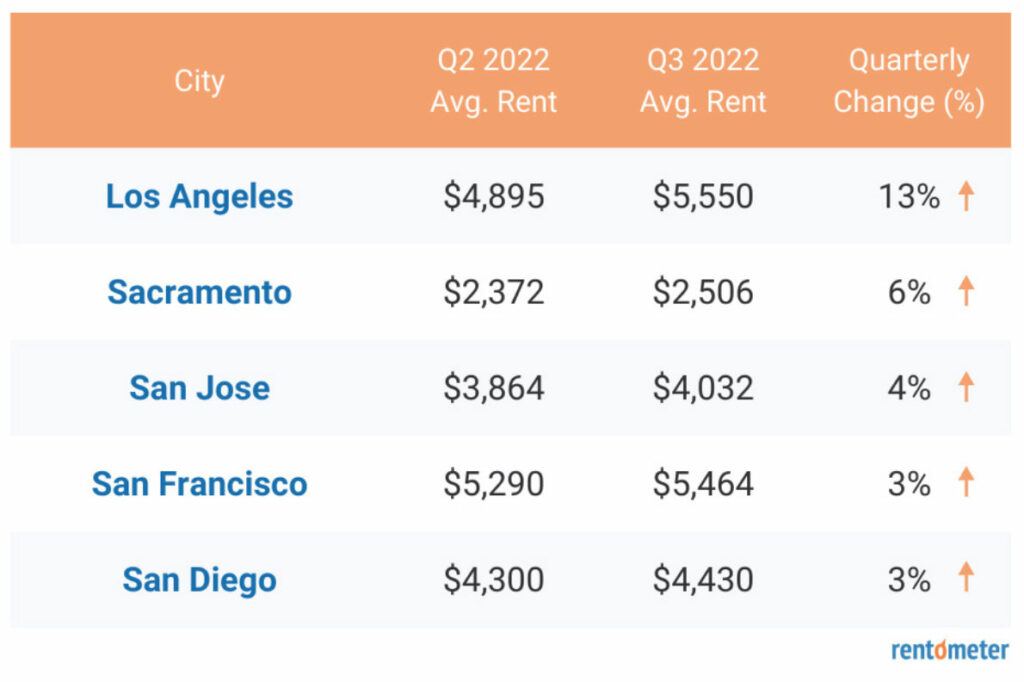

Rentometer’s 4th Quarter 2022 data is returning some mind boggling numbers. In just one year San Diego’s average rent has gone from $3,800 to just over $4,500 per month. Our landlord borrowers are utilizing the equity in their properties to rehab old properties to capture this increase in cashflow. This is also driving up property values of multi-family properties. Many of our long-term landlords are aggressively upgrading their portfolios of properties to larger buildings with more units.

Source: Rentometer.com

Just like last month these landlords continue to make up a majority of our application volume, especially in Los Angeles, Orange and San Diego counties. Meanwhile, the industrial market continues to experience a steady state with supply and demand levels are at historic norms. We only see a few applications for this segment as the financing requests skew to $1M-plus. Generally, the deals are solid with very low LTVs and we welcome any brokers who want to partner with us. The commercial market continues to be a mixed bag. Kidder Mathews market research reporting that in the 4th Quarter rental rates are trending up and vacancies are trending down as workers slowly return to the office.

Big banks are locking down their vaults to mitigate risk and prepare for a possible recession. It is becoming increasingly difficult for borrowers to qualify for financing. This is especially true for those who are self-employed, own their own business or have less than perfect credit. This means that many existing borrowers are having difficulty refinancing to pay off existing liens or pull cash out on a refi. The availability issues of conventional financing is pushing up rates for trust deeds as well. Across the market in California for private mortgages and trust deeds we are seeing elasticity in rates that borrowers are willing to accept.

Thank you for all our existing partners who have been referring over friends & family to join us. Please contact Scott Griest at Scott@CoastalCapital.com if you would like to add to your investment.

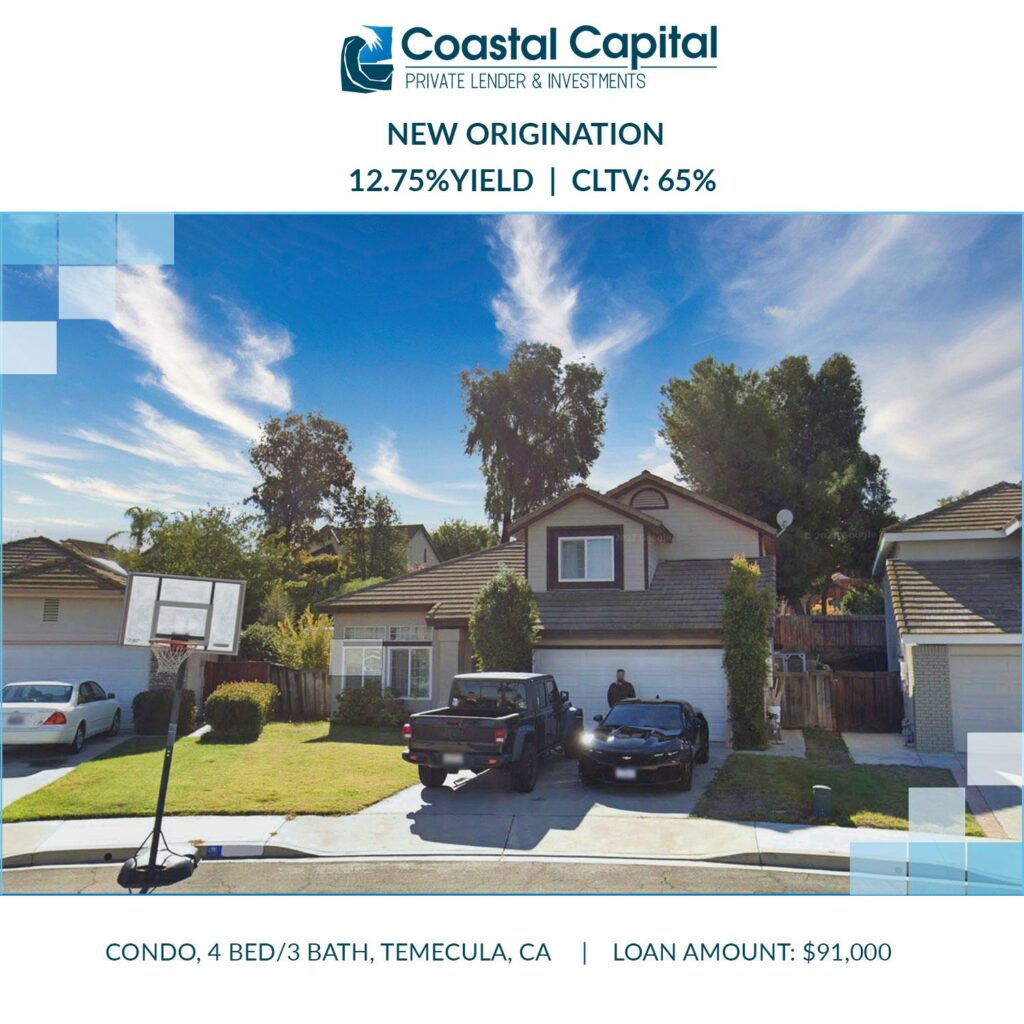

Another small business owner needed to access the equity in his home fast! The family had the opportunity to buy inventory from a competitor going out of business. The request for financing was $150,000 but we were not comfortable pushing the loan-to-value that high on this property. This situation occurs quite often when borrowers think their property’s value is sky high. Thanks to the tireless efforts of a great broker all parties got to a deal that everyone was comfortable with. After four days of back-and-forth Coastal Capital were able to close in a week. Can’t wait to do more deals with this professional brokerage group. They made a hard-to-get-done deal look easy! |

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

As we wrap up 2022, we are reflecting on the changes we’ve all experienced since the beginning of the year. We have gone from 3% conventional mortgage rates to well over 7% and now settling in around 6.5% as we close the year. Tons of uncertainty hit the residential mortgage market for single family homes as financing rates marched North with the Federal Reserve steadily raising rates at every recent meeting. Currently there is a inventory supply issue for the SFRs all the way from the low-end to the high-end of the market. Existing homeowners have no desire to trade in there 3% (often even lower rate) that’s locked in for 15 or 30 years! New inventory entering the market is being driven by life events such as job relocation, marital status changes, etc. Many prospective home buyers are paralyzed; wondering if rates and home values will drop in the coming months and they want to avoid overpaying for a property or for financing. California still has has a three-month supply of SFRs on the market. While sales volumes are down 40% year-over-year with the number of completed transactions plummeting, home values for most California markets are relatively flat, except for the Bay-area which is down roughly 5%. Reality setting in for home sellers that normalcy has returned to the market with homes taking weeks (not days) to enter escrow and it’s a more balanced market with buyers having some negotiation power on price and/or concessions. The multi-family & industrial markets are a completely different story! Rents keep powering upward across almost all categories: SFR, Multi-Family & Industrial properties. For the residential markets in California the home affordability index is at historic lows. CNBC is reporting that Los Angeles is the 2nd least affordable housing market coming in just below Miami and above New York City! This index compares housing prices to median incomes. As more first-time home buyers sit on the sidelines renting, they put even more pressure upward on rents. Latest data released this week from Rentometer shows all major metropolitan markets moving upward by at least 3% in just the last quarter alone. Los Angeles leads the charge with a 19% increase in rents during the past just 3 months! No wonder our application desk is filled with requests for financing from residential income property landlords. They are renovating existing properties and scooping up any multi-family unit property that comes on the market in days (if not hours.). Industrial properties are not seeing as large of an increase but are still increasing quarter after quarter. |

Source: Rentometer.com Landlords continue to drive the majority of our application volume as they collect premium rents, especially in Southern California. We continue to see a wide range of 1st & 2nd position trust deed flow come in from our brokers in this client segment. Existing clients who are building their income property portfolio are purchasing everything and anything they can find no matter the property’s condition. Thank you for all our existing partners who have been referring over friends & family to join us. Just a reminder that initial investment amount requires $100,000; existing partners in the Fund can add on in any amount from $2,500 or more. |

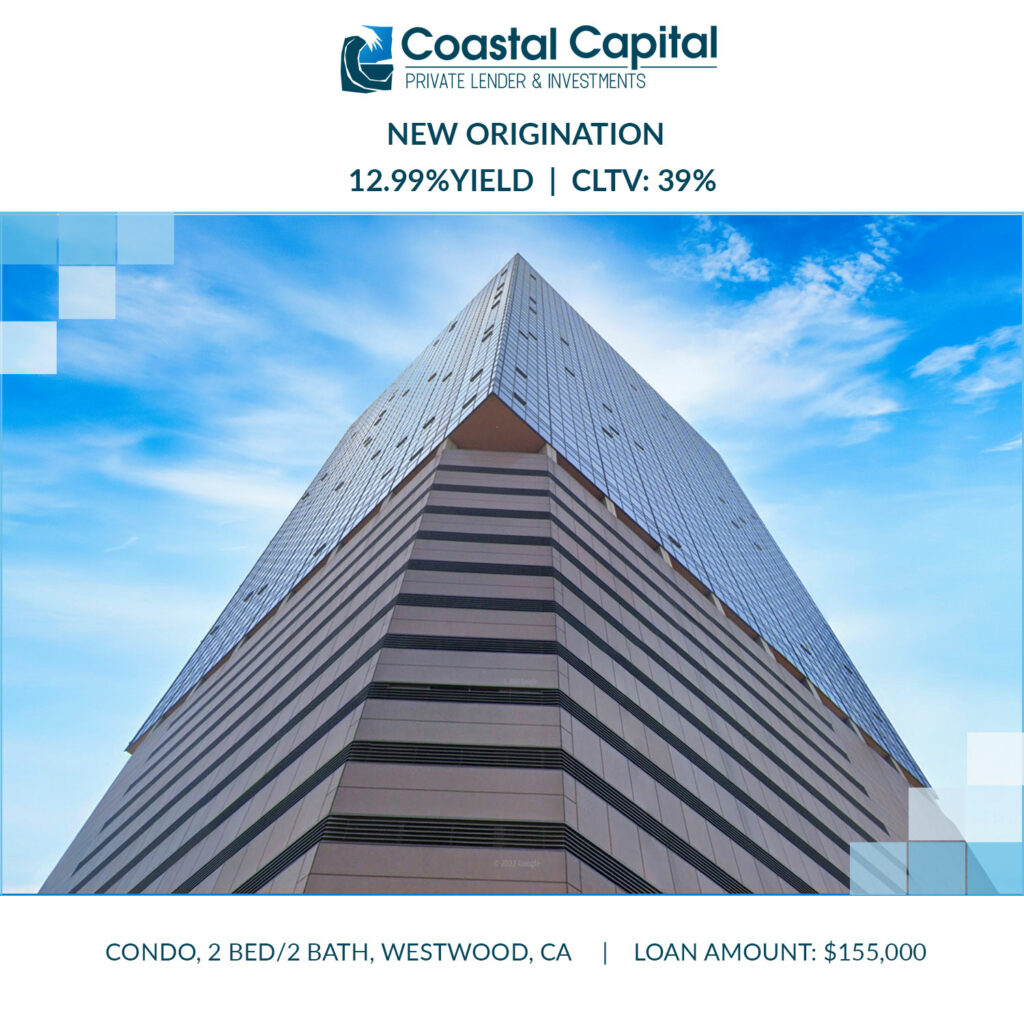

A long-time client who specializes in residential income properties recently purchased a beautiful duplex in West Hollywood and needed just minor upgrades before putting it on the rental market. Unfortunately, there was not enough equity in the new property for Coastal Capital to provide financing. So, we suggested to his broker using the equity in a condo that we had financed before! |

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713

First Trust deed investing is simply investing in loans secured by real estate. This could be in first or second lien position with various terms from 1, 3, or 5 years. Most trust deed investments are relatively short-term loans made to professional real estate developers. Coastal Capital focuses on Business Purpose Loans in California. Returns on trust deed investing range from 8% to 14% depending on the borrower risk profile and lien position.

Some professional real estate developers specialize in flipping properties meaning buying them, fixing them up, and reselling them for a profit. These developers often need loans to pay for the properties and renovation costs. Time is of the essence, so borrowers don’t want to wait 30-60 days to get approval from a bank.

Banks are reluctant to lend to these developers for several reasons, so the developers look for alternative lending options. Trust deed investors and trust deed funds fill this gap in the market by offering short-term loans. In return for making these loans, trust deed investors can earn attractive returns with relatively low risk.

Banks are reluctant to make short-term loans to real estate developers primarily because doing so isn’t a good fit for their business model. Banks like longer term relationships.

There’s more demand for short-term real estate loans than there is supply which benefits trust deed investing. The limited supply has nothing to do with the quality of the borrowers or loans, and it creates an investment opportunity for trust deed investors.

If structured properly, trust deed investing offers an attractive current yield with relatively low risk. Trust deed investors usually earn high single-digit annual returns, paid monthly. In some cases, returns above 10% are possible.

These returns are very favorable relative to other investment options with similar risk profiles, such as bonds. You can mitigate the risk of losing money in a trust deed investment by building an adequate margin of safety with conservative CLTV’s.

The margin of safety is the difference between the loan amount and the value of the underlying property. Trust deed investing is that if the borrower does not perform (that is, pay back the loan on time, as agreed), the lender can foreclose on the property and sell it to recoup the investment, plus any past due interest. This is especially true in business purpose loans versus traditional consumer mortgages.

If the value of the property securing the loan is high relative to the loan amount, then the investment should NOT lose money even if the borrower defaults on the loan. A maximum trust deed investment might have a cumulative loan-to-value (CLTV) of 65%, meaning the loan is equal to about 65% of the property’s value.

A Loan-to-Value (LTV) is when there is one loan or lien, when there are 2 loans or liens then it’s a cumulative Loan-to-Value (CLTV).

For example, a trust deed investor might lend $650,000 on a property with a value of $1,000,000. If the borrower doesn’t perform, the lender, fund or the trust deed investor can foreclose on the property and, in the vast majority of cases, sell it for more than the loan amount.

As of 2022, investors in a first trust deed fund can expect to earn 9% to 12% annual returns depending on that fund’s particular strategy and risk profile. Coastal Capital’s fund has been performing very well since 2007.

Professional Trust Deed Investors who source and originate their own loans can charge borrowers an annual interest rate of 9% to 9% plus 1 to 2 points for a 12-month loan at 75% to 80% loan-to-cost (LTC). Annualized, that is an 8% to 11% return, but that assumes the investor is able to source and originate a new loan immediately after the first loan pays off.

We explain points, LTC, and first trust deeds versus second trust deeds in more detail later in this FAQ.

Area of Lending: California Only

Funding: As Little As 5 Days, Always Less Than 10 Must have a completed file

Occupancy: Owner- & Non-Occupied (proceeds to be used for business purposes/generate income)

Property Types Residential: SFR, Multi family, Condo, Townhouse, 2 – 10 Units, Land, Light Commercial, Flip

Property Condition: Property must show “Pride of Ownership”, properties with deferred maintenance will have a reduction in loan amount or hold back

Loan Terms:

Prepayment Penalty Protection: 3 – 6 Months

Lending to: Individuals | Foreign Nationals | Corporations | LLC | LLP | Family Trusts

Minimum Credit: No minimum credit score required (must have an active mortgage reporting)

Documentation Needed:

All investment strategies come with risk, and Trust Deed Investing is no different. It’s best to seek guidance from trusted, experienced investors or fund managers. Creating a valid trust deed and accompanying note is not rocket science.

There are four main options for an individual to invest in trust deeds:

Read on to learn more about the pros and cons of each option.

When investing in a fund, investors are delegating all day-to-day decisions to the fund manager. Evaluating the competence, character, and trustworthiness of the fund manager is critical. Investing in trust deeds can be done in a responsible low-risk manner; however, an incompetent fund manager can make mistakes that result in money being lost. In the worst case, a dishonest fund manager could steal the money that is supposed to be invested.

We offer guidance on how to evaluate a fund manager below, in answer to the question, “How can I evaluate someone offering trust deed investments?”

Most brokers and investment firms require minimum investments in trust deeds, but the exact amount will depend on who is offering the investment. Some investment firms allow investments as small as $10,000 while others require $100,000.

Successful trust deed investing requires thorough research on each investment, so it often makes more sense to invest a larger amount in a smaller number of investments rather than spread funds across many very small investments where the research behind each investment was more superficial.

The answer depends on your circumstances and preferences. If you prefer to actively manage your investments and you have deep knowledge of real estate investing, you may earn higher returns investing in individual trust deeds than investing in a fund like Coastal Capital’s Trust Deed Fund.

Each loan requires a great deal of analysis and due diligence on both the borrower and the property. When a loan pays off, the money sits in cash until it can be redeployed. Investing in individual trust deeds requires constant sourcing of deals so that when one loan pays off, the money can be reinvested quickly in another. The bottom line is its very consuming and marketing to get new deals may eat into your profits.

Passive investing via a professionally managed fund can save you time and effort. A good fund manager will have the infrastructure and expertise to analyze, underwrite, and perform other due diligence on individual loans. An established fund manager will also be in a better position to source deals and ensure that money is continuously reinvested.

Neither is better, but they are different, primarily with respect to valuation and due diligence.

Valuation

Commercial properties such as multi-unit apartment buildings or shopping centers are valued based on the cash flow, they produce each year. Single family residential properties are valued based upon comparable property sales in the neighborhood, not on their income potential.

Due diligence

Commercial property trust deeds require extra due diligence that the average investor may not be familiar with carrying out. For example, when investing in a trust deed secured by a shopping center or an industrial building, it is critical to have an environmental assessment of the property prior to funding. The presence of any environmental problems is a major red flag and could expose the trust deed investor to significant liability.

Whether you’re considering commercial or residential trust deeds, the key is to make sure that the LTV is conservative.

Yes. The first step is to work with a self-directed IRA custodian company. These firms specialize in administering IRAs that are invested in alternative asset classes such as real estate, trust deed funds, and commodities.

Two established firms based in California that work with Coastal Capital are U-Direct and Entrust.

The loan servicer collects interest payments from the borrower and disburses them to the lender. The servicer also initiates the foreclosure process at the request of the lender in case of default by the borrower. One of the largest servicers for trust deed investments in California is called FCI Lender Services.

The loan servicer manages the cash payments from start to finish. Initially from the loan setup, collecting the monthly payments to the payoff report. See the Standard Loan Servicing from FCI.

Loan-to-value (LTV) is the total amount of the loan divided by the value of the property.

If a property is worth $400,000 and the loan amount is $240,000, then the LTV equals $240,000/$400,000 or 60%.

Loan-to-Value is important because the margin of safety is directly related to the LTV. A low LTV means a higher margin of safety for the lender. An LTV of 65% or lower is generally a good signal, although for a very small loan even a low LTV may not equate to a safe loan.

If the borrower fails to make an interest or principal payment or fails to live up to some other provision of the loan agreement, a default occurs. At this point, the lender Coastal Capital instructs the loan servicer FCI Lender Services (to file a notice of default.

This is the first step in a series of events that culminates in a foreclosure sale. In California, it takes about four months after the notice of default is filed to hold a foreclosure sale.

At any time after the notice of default and before the foreclosure sale, the lender and borrower could make arrangements that would eliminate the need for the foreclosure sale. For example, the borrower could cure the default by making all the payments due. Or the lender could give the borrower more time to pay back the loan.

When a foreclosure sale does take place, there are two main outcomes.

Trust deeds can earn you a great return on investment (ROI) and can perform better than other asset classes. In times of volatility in equities, the steady yields of trust from 7.5% to 13% can provide a good base of gains in your investment portfolio. Many investors commit 30% to 50% of their portfolio to trust deeds to ensure month cash flow.

There is going to be some volatility in your portfolio; however, you can dilute this by having diversity in your investment choices. One way is to fund trust deeds in different real estate markets. Another way is to invest in multi-lender, or fractional loans invest in multi-lender, or fractional loans, where you are investing in many loans with other investors rather than just a handful of whole loans. Many investors choose to join a share-based fund, such as Coastal Capital, where they essentially buy into a LLC partnership and own their pro-rata share of a hundred plus trust deeds. Trust deed funds provide instant diversification and eliminate to deal with other investors or lenders that may disagree on how to unwind a deal.

All trust deeds are secured by real property. If the borrower defaults on the loan, your funds are secured with the real estate collateral that you can initiate the foreclosure to get your money back. Ideally, lenders and borrowers want to avoid foreclosure, working out a payment or loss mitigation agreement allowing the borrower to bring the payments current or pay off the loan entirely through a property sale or refinance.

Not only are trust deeds secure, they are stable and predictable as long as you’re carefully underwriting the loan and not overleveraging the property. The interest rate and monthly payments are usually the same throughout the duration of the loan, allowing you to budget your income or reinvestment strategy.

With trust deeds, you do your due diligence on the loan, fund the loan, and let your broker set up the loan servicing, then wait for the payments to arrive each month via electronic deposit. Or, you simply invest in a Fund and let the management handle the entire process and just collect your share of the monthly interest (make sure you know all fees prior to investing.) It’s a much easier process than being a landlord and managing your own properties.

Some trust deed investors utilize self-directed retirement accounts, 401Ks, IRAs, or pension plans they manage through their investments. Companies such as uDirect and Entrust make it easy to change from a traditional IRA or Roth Ira where you can only invest in mutual funds, stocks & bonds to one where the investor has complete checkbook control. At Coastal Capital this option is extremely popular for our investors in their forties and early fifties are aiming for higher yields from 10.00 to 12.00% while removing risk and market gyrations.

Since 2007 Coastal Capital has provided short-term loans secured by real estate to developers & real estate investors who purchase, rent, renovate, and resell single family homes, multifamily buildings, light-commercial properties, and land. There are numerous reasons why borrowers may need liquidity (such as paying off other debt, improving a property to raise rents, difficulty for the self-employed to qualify, traditional bank timeline is to funding is to lengthy, etc.) and are willing to pay above-market rates. These loans provide investors with a consistent stream of income from interest payments while allowing borrowers to access working capital for their projects.

In conclusion, it’s best to plan next year and multiple years out if you’re nearing retirement. Having multiple steams of income during retirement elevates a lot of financial stress. Visit www.CoastalCapital.com for more information about their trust deed income fund.

Retirement from the workplace means you need income during retirement which could be troublesome if not planned properly. You should still be making money after you stop working. Below are simple ideas to generate income during retirement.

Trust deed investing is investing in loans secured by real estate either secured by first trust deeds, second trust deeds, or mortgage and promissory notes. Just this type of investing can provide high degree security diversified over multiple properties or trust deed funds. Trust deed investments offer an attractive current yield with relatively low risk secured by a real asset. Trust deed investors usually earn 8% to 12% annually depending on the LTV (Loan-to-Value), collateral, and FICO score of the borrowers. Interest payments are usually paid out monthly. See Coastal Capital based in Culver City, CA and managed by Chris Tomaszewski www.CoastalCapital.com.

Investors can opt to invest in a fractional trust deed, the entire trust deed or in a fund that invests for them. Most investment firms require minimum investments in trust deeds, but the exact amount will depend on who is offering the investment. Some investment firms allow investments as small as $10,000 while others require $100,000 or more. The minimum amount will similarly vary by broker. Other names for these types of loans can be asset-based loans, private money loans, business purpose loans.

The construction of laddered CD’s mirror the technique for building a bond latter. You might start out buying these bonds before retirement in 1, 5, 10, 15-year increments for multiple years. This way you have less interest rate risk and less capital needed all at once. Maybe take your tax return refund to start buying CD’s and expand from there.

Being tax efficient during retirement takes some planning and strategy. Are you planning on working part-time as a W-2 wage earner? Maybe structure it as a business that take advantage of multiple tax deductions. Are you planning to start a new hobby that uses up a lot of supplies and resources like horseback riding? Maybe volunteer at a stable instead or if you’re planning on painting then volunteer at a hobby store or arts festival.

Owning rental property provides a great steam of monthly income, a hedge against inflation, capital appreciation, depreciation benefits and a great way to off-set other expenses. This is similar to Coastal Capital Trust Deed fund, but you are directly owning the asset vs the fund you own the Note.

If you have some real estate or have a financial background, think about getting your real estate license. This could be helpful if your friends are downsizing and need to sell their house and then buy a new one…2 transactions = 2 commissions. If you’re well connected from your past employment, church, or neighborhood then you might be able to represent a few buyers and sellers in a year and earn a great commission on each transaction.

Setting up a variety of income streams can protect you in case one revenue stream dries up!!

Such as:

Think outside the box and look at trust deed investments with Coastal Capital for your next income stream.

In conclusion, it’s best to plan next year and multiple years out if you’re nearing retirement. Having multiple steams of income during retirement elevates a lot of financial stress. Visit www.CoastalCapital.com for more information about their trust deed income fund.

Since 2007 Coastal Capital has provided short-term loans secured by real estate to developers. There are numerous reasons why borrowers may need liquidity and are willing to pay above-market rates. These loans provide investors with a consistent stream of income from interest payments while allowing borrowers to access working capital for their projects.

Retirement from the workplace means you need income during retirement which could be troublesome if not planned properly. You need a proper nest egg to draw on during up and down stock markets and recessions. Below are simple ideas to generate income during retirement.

Trust deed investing is investing in loans secured by real estate either secured by first trust deeds, second trust deeds and promissory notes. Trust deed investments offer an attractive current yield with relatively low risk secured by a real asset. IInvestors usually earn 8% to 12% annually depending on the LTV (Loan-to-Value), collateral, FICO score of the borrowers, overall credit worthiness, etc. Interest payments are usually paid out monthly. See Coastal Capital based in Culver City, CA and managed by Chris Tomaszewski www.CoastalCapital.com.

Investors can opt to invest in a fractional trust deed, the entire trust deed or in a fund that invests for them. Most brokers and investment firms require minimum investments in trust deeds, but the exact amount will depend on who is offering the investment. Some investment firms allow investments as small as $10,000 while others require $100,000 or more. The minimum amount will similarly vary by broker. Other names for these types of loans can be asset-based loans, private money loans, business purpose real estate loans.

Quote from Scott Griest from Coastal Capital in Culver City…” I recommend my friends and family to invest in Coastal Capital especially via a self-directed IRA to maximize the investment benefits.

Why Do Trust Deeds offer higher returns?

Some professional real estate developers specialize in flipping properties – that is, buying them, fixing them up, and reselling them for a profit. These developers often need loans to pay for the properties and renovation costs.

Banks are reluctant to lend to these developers for several reasons, but speed is usually at the top of the list. Investors fill this gap in the market by offering the short-term loans the developers need. In return for making these loans, trust deed investors can earn attractive returns with relatively low risk. Trust deed investment can be made on land, residential and commercial properties.

Social Security provides a guaranteed source of income in retirement. But the amount received will vary greatly depending on years worked, earnings and when you start drawing on social security. For more details check out these 5 tips to increase your social security check.

Being tax efficient during retirement takes some planning and strategy. Are you planning on working part-time as a W-2 wage earner or a business owner that can take advantage of multiple tax deductions. Are you planning to start a new hobby that uses up a lot of supplies and resources like horseback riding? Maybe volunteer at a stable instead or if you’re planning on painting then volunteer at a hobby store or arts festival.

If you have some real estate or have a financial background, think about getting your real estate license. This could be helpful if your friends are downsizing and need to sell their house and then buy a new one…2 transactions = 2 commissions. If you’re well connected from your past employment, church activies, or your neighborhood then there is an opportunity! You might be able to represent a few buyers and sellers in a year and earn a great commission on each transaction.

Become a tutor in your respective field to train the next generation in the skills that you have learned. You become a substitute teacher at a high school or community college. See other ideas in retirement at https://www.newretirement.com/retirement/best-part-time-jobs-for-retirees/

In conclusion, it’s best to plan next year and multiple years out if you’re nearing retirement. Having a stable steady income during retirement elevates a lot of financial stress! Visit www.CoastalCapital.com for more information about their trust deed income fund.

You do have other options besides the stock market for stable income besides CD’s and dividend paying bonds. Investors at some point in their life want a consistent stable income to avoid the volatility of the stock market or other alternative investments. Alternative options might be a little more work but well worth the investments return.

Trust deed investing is simply investing in loans secured by real estate either secured by first trust deeds, second trust deeds, or mortgage and promissory notes. If structured properly, trust deed investments offer an attractive current yield with relatively low risk. Trust deed investors usually earn high 8 to 12 percent annually depending on the situation; see www.expresscashflow.com/bridge-loan for example.

Investors can opt to invest in a fractional trust deed, the entire trust deed or in a fund that invests for them. Most brokers and investment firms require minimum investments in trust deeds, but the exact amount will depend on who is offering the investment. Some investment firms allow investments as small as $10,000 while others require $100,000 or more. The minimum amount will similarly vary by broker.

Why Do Trust Deeds offer higher returns?

Some professional real estate developers specialize in flipping properties – that is, buying them, fixing them up, and reselling them for a profit. These developers often need loans to pay for the properties and renovation costs.

Banks are reluctant to lend to these developers for several reasons, but speed is usually at the top of the list. Trust deed investors fill this gap in the market by offering the short-term loans the developers need. In return for making these loans, trust deed investors can earn attractive returns with relatively low risk.

In today’s chaotic financial markets cash is king and stable income is on the top of everyone’s list. Multiyear guaranteed annuities (MYGAs) are the annuity industry’s version of bank CD’s that deliver a higher yield. MYGA’s are insurance contracts purchased through a licensed insurance agent in your state of residence. You can research and buy them on the websites of agents licensed such as StanTheAnnuityMan.com and ImmediateAnnuities.com

MYGA’s annual interest rate is fixed for its entire term, which typically ranges from one to 10 years. Your principle’s value is guaranteed not to decline, plus all the fees, expenses and commissions are included in the quoted interest rate.

If you want to get more involved in your investments peer-to-peer lending is one alternative to generate stable income. Peer-to-peer investing is when you apply for a loan and receive the funds from one or multiple individual investors rather than a bank.

Peer-to-peer term loans are usually one, three, or five years. These shorter repayment terms mean you can get rid of your debt a little quicker this way rather than if you were to take on a different kind of loan.

CD’s and bonds may not be ideal when inflation is higher than average. TIPS help you keep up with inflation. TIPS are government issued bonds that aim to protect against rising inflation. The bonds principle adjusts with inflation and deflation for 5, 10, 30-year terms.

There are several alternative investment options beside the stock market, but it will require a little more research then just clicking the Buy button. Trust deed investments via a fund that Coastal Capital offers could deliver twice the returns of TIPs and MYGA investments. To learn more about Coastal Capital’s fund, their investment strategy, stable returns over time since 2007 and their minimum investment please visit www.CoastalCapital.com for stable income options.