December Latest Updates & Insights

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

MARKET UPDATE

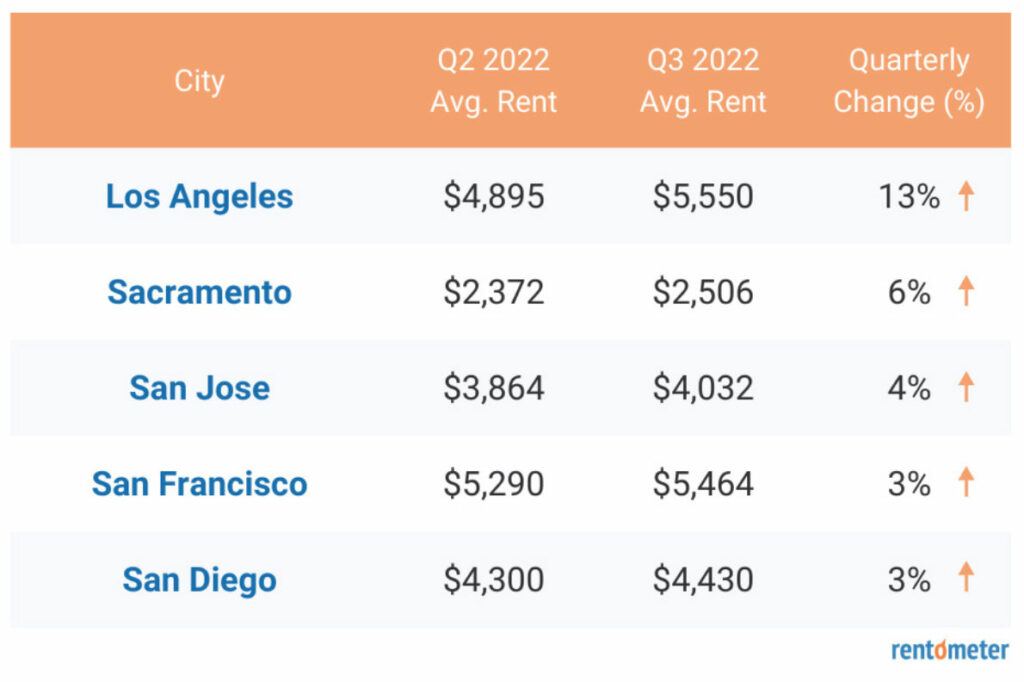

As we wrap up 2022, we are reflecting on the changes we’ve all experienced since the beginning of the year. We have gone from 3% conventional mortgage rates to well over 7% and now settling in around 6.5% as we close the year. Tons of uncertainty hit the residential mortgage market for single family homes as financing rates marched North with the Federal Reserve steadily raising rates at every recent meeting. Currently there is a inventory supply issue for the SFRs all the way from the low-end to the high-end of the market. Existing homeowners have no desire to trade in there 3% (often even lower rate) that’s locked in for 15 or 30 years! New inventory entering the market is being driven by life events such as job relocation, marital status changes, etc. Many prospective home buyers are paralyzed; wondering if rates and home values will drop in the coming months and they want to avoid overpaying for a property or for financing. California still has has a three-month supply of SFRs on the market. While sales volumes are down 40% year-over-year with the number of completed transactions plummeting, home values for most California markets are relatively flat, except for the Bay-area which is down roughly 5%. Reality setting in for home sellers that normalcy has returned to the market with homes taking weeks (not days) to enter escrow and it’s a more balanced market with buyers having some negotiation power on price and/or concessions. The multi-family & industrial markets are a completely different story! Rents keep powering upward across almost all categories: SFR, Multi-Family & Industrial properties. For the residential markets in California the home affordability index is at historic lows. CNBC is reporting that Los Angeles is the 2nd least affordable housing market coming in just below Miami and above New York City! This index compares housing prices to median incomes. As more first-time home buyers sit on the sidelines renting, they put even more pressure upward on rents. Latest data released this week from Rentometer shows all major metropolitan markets moving upward by at least 3% in just the last quarter alone. Los Angeles leads the charge with a 19% increase in rents during the past just 3 months! No wonder our application desk is filled with requests for financing from residential income property landlords. They are renovating existing properties and scooping up any multi-family unit property that comes on the market in days (if not hours.). Industrial properties are not seeing as large of an increase but are still increasing quarter after quarter. |

Source: Rentometer.com Landlords continue to drive the majority of our application volume as they collect premium rents, especially in Southern California. We continue to see a wide range of 1st & 2nd position trust deed flow come in from our brokers in this client segment. Existing clients who are building their income property portfolio are purchasing everything and anything they can find no matter the property’s condition. Thank you for all our existing partners who have been referring over friends & family to join us. Just a reminder that initial investment amount requires $100,000; existing partners in the Fund can add on in any amount from $2,500 or more. |

PORTFOLIO HIGHLIGHT

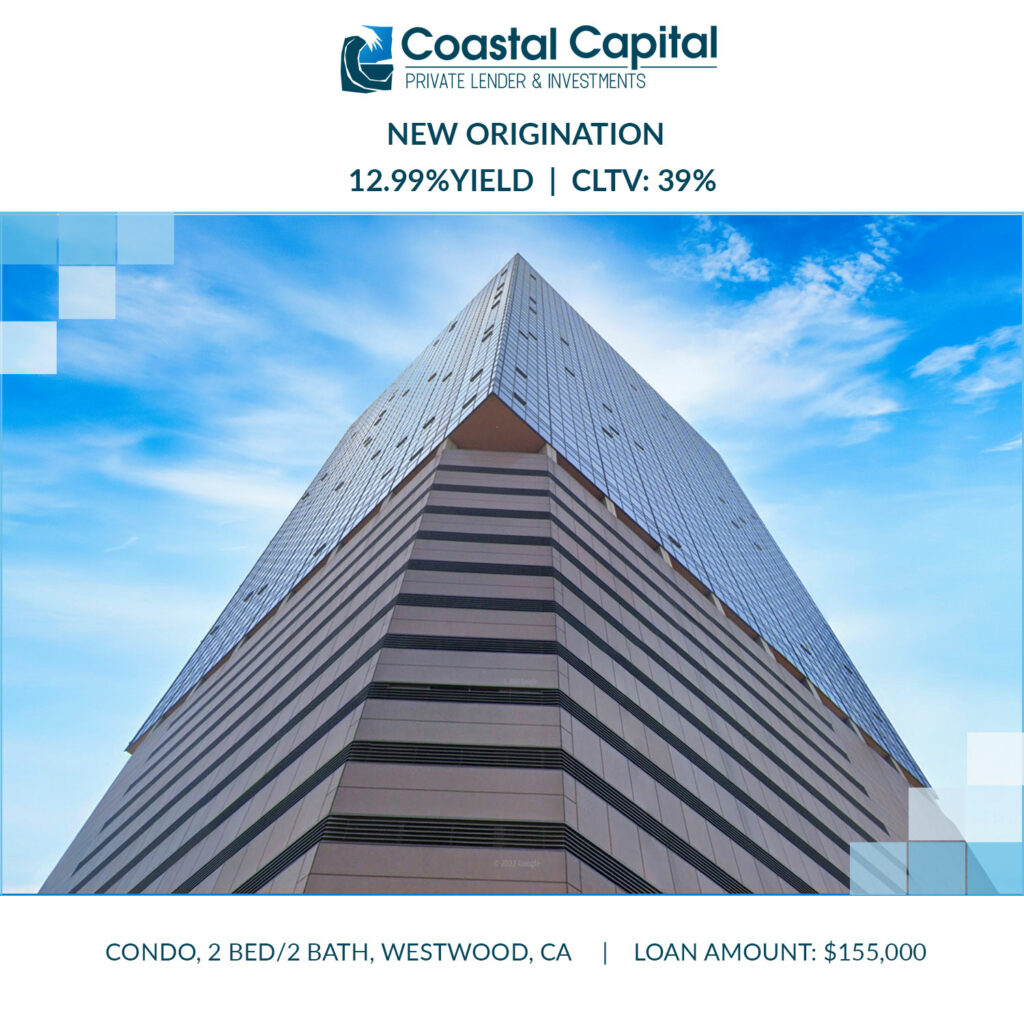

A long-time client who specializes in residential income properties recently purchased a beautiful duplex in West Hollywood and needed just minor upgrades before putting it on the rental market. Unfortunately, there was not enough equity in the new property for Coastal Capital to provide financing. So, we suggested to his broker using the equity in a condo that we had financed before! |

- Condo 2 BED / 2 BATH

- Westwood, CA

- Position: 2nd TD

- Rate: 12.99%

- CLTV: 39%

- Appraised Value: $900,000

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $25,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713