May Latest Updates & Insights

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

MARKET UPDATE

Low, low inventory levels of single-family residency & multi-family homes continues into this Spring selling season (which is historically the busiest time of the year) for real estate agents. As of May 6, the inventory of single-family homes for sale statewide was at 26,627 homes, slightly below where it was exactly a year ago (26,994 homes) and well below early May 2019 inventory levels, which came in at over 60,000 homes, according to data from Altos Research. We are seeing this trend across markets south of the Bay area and at all price levels. Entry level homes less than $750,000 are being snatched up quickly if priced within reason. In the Bay area the social issues of homelessness, crime and exodus of tech workers has hit the area hard and inventory is flowing as people leave to greener pastures of California (Coastal Capital has pulled back significantly from the area in 2022 with only one trust deed in the area.)

“It is very different from what we saw in the fall,” Ryan Lundquist, a Sacramento County-based residential real estate appraiser and market analyst, said. “It is like the market went from an ice bath to a blood bath — it is very competitive, and buyers are feeling frustrated at the lack of options.”

And it appears that the low inventory situation won’t be ending any time soon, as the number of new listings coming to market is also well below where it was last year. During the week ending May 6, 4,942 new listings of single-family homes came to market in California. A year ago, 7,684 new listings came on the market during the same week, and in 2019, 8,188 new listings were added, according to Altos. We predict the current Seller’s Market will continue for the near- and mid-term.

Source: Altos Research

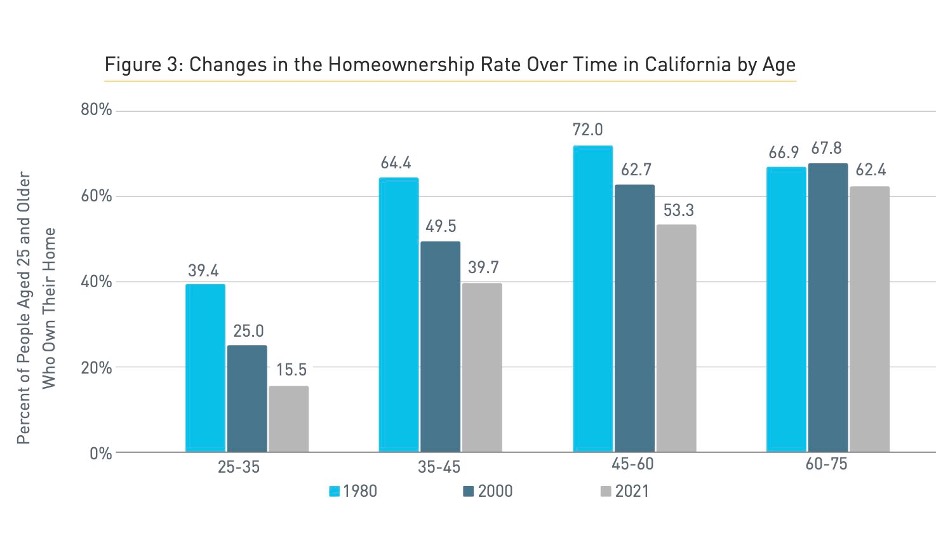

The theme of high rents throughout California continues. While the rental rates are no longer sky rocketing, they are holding steady and creeping up. The ROI for landlords continues to drive the demand for multi-unit buildings. Young Californians won’t be surprised to hear that homeownership rates are declining in their age group. Now a new study from Terner Center for Housing Innovation from UC Berkley finds that on average, it takes longer to become a homeowner in California than in any other state.

The point when half of Californians at any given age become homeowners is 49, according to the study. That exceeds other expensive states like New York (46), and it’s much higher than many of the states Californians have been flocking to, such as Texas (37) and Arizona (35). The study finds that in 1980, almost two-thirds of Californians aged 35 to 45 owned a home, but only 40% of residents in that age group owned a home in 2021.The same trend is happening among younger age groups. About 40% of Californians aged 25 to 35 owned a home in 1980, but only 16% in that age group own homes today.

Source: Terner Center for Housing

Without new building starts or a massive migration exiting California we expect that landlords will continue to make up a majority of our application volume, especially in Southern California from Santa Barbara to the Mexican border. The light commercial and industrial markets continue to chug along as normal. Our applications desk has seen an uptick in deal flow in this segment. We feel this segment of the marketplace is normal except for office space which continues to struggle as workers fight their employers on returning to the office. This month we did fund our first commercial deal at an incredible LTV.

Small business owners are turning to private money lenders for their business-purpose loans in droves. Banks with all the recent failures are hoarding cash and the last person they want to loan it to is someone who is self employed without significant assets. The availability issues of conventional financing is really increasing demand for our trust deeds in this segment. Across all markets in California for private mortgages & trust deeds we are seeing elasticity in rates that borrowers are willing to accept ranging from 12% to 14%-plus.

Thank you for all our existing partners who have been referring over friends & family to join us. Just a reminder that initial investment amount requires $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

PORTFOLIO HIGHLIGHT

Just when we thought we had seen every possible scenario a new one came across our desk. A local real estate office in Modesto, California took over a church and paid cash for it to transform into their offices. They needed just a little bit of financing to finish the interior renovations but even with perfect credit they found it difficult to find a cooperative lender given the uniqueness of the property. While not a typical deal structure, Coastal Capital immediately understood the equity position and provided the broker with a quick solution!.

- Church Converted to Office

- Modesto, CA

- Position: 1st TD

- Rate: 12.99%

- CLTV: 27%

- Appraised Value: $500,000

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $25,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713