October Latest Updates & Insights.

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

MARKET UPDATE

As predicted conventional mortgages continue their march up higher! In late October the average 30-year fixed mortgage rate topped 7.3% a jump from just over 7% at the beginning of the month according to Bankrate.com. Much of the increase is being driven by the Fed’s stoppage of purchasing mortgage securities which artificially suppressed mortgage rates over the past few years. We fully expect rates to continue their slow but steady climb in the short- and mid-term as the Federal Reserve continues to raise rates. The stock market also continues to be in turmoil with a general consensus that the bull market is done and we are headed into a mild recession. The smart money is all rushing towards solid assets such as real estate, real estate funds, precious metals, blue chip crypto currencies & solid, bellwether stocks.

Good quality commercial, industrial and multi-family units are still in demand. Many of these buyers have locked in mortgage pool rates previously or have cash to pounce. We do eventually expect a minor pullback in these segments as rates increase. A and B rated proprieties with low CAP rates on commercial yields are now close to treasury rates which might result in lower purchase demand that is not 1031 exchange driven, now that there is an alternative. The rate increase has left many buyers in the single-family residential market paralyzed. First time home buyers are concerned that they are buying the top of the market and by waiting a few months they can get a deal. Current homeowners, most of whom locked in low rates, are experiencing payment shock when exposed to current rates as compared to their existing sub-4% rates. Rates have more than doubled from last year this time adding more than $1,000 to the monthly payment for a median-priced home in Southern California. What this has done is greatly suppress the number of transactions done in the SFR market. September 2022 sales were down roughly 25% as compared to a year ago, especially on the lower end of the market where buyers are more payment sensitive. On the high $1M price range the volume of sale drop has been much more subdued coming in at just 9% lower as compared to September 2021.

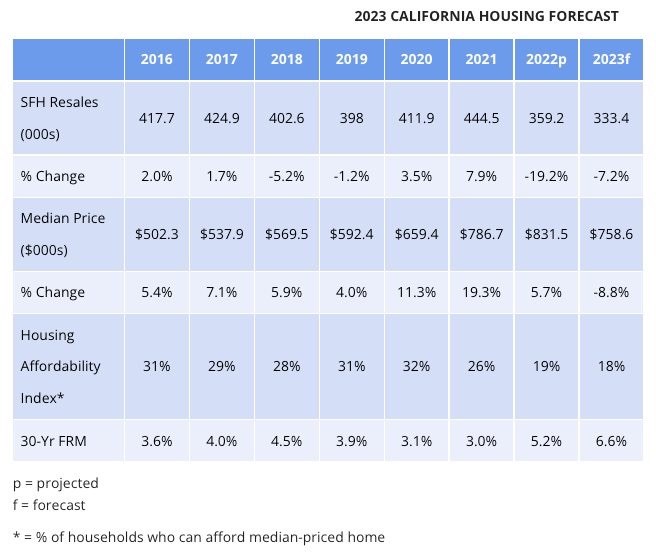

The California Association of Realtors just released their 2023 California Housing Market Forecast earlier this month. We are happy to report that their prediction is right in line with our Insights newsletter predictions this year.

|

Even though prices will dip some the average interest rate will push up payments as compared to 2022. This will continue to make housing affordability out of reach for money continuing to put pressure on rental rates. We think the President of the Association’s quote sums it up pretty well:

“As sellers adjust their expectations, well-priced homes are still selling quickly. And for buyers: more homes for sale, less competition, and fewer homes selling above asking price, all point to a more favorable market environment for those who were outbid or sat out during the past two years when the market was fiercely competitive.”

For the Fund we continue to see record application flow coming across our origination desk. Demand for our trust deeds continues strong from our two main borrower segments. Big banks have drastically cut back on lending to their small business clientele. We continually hear stories of solid business owners who have had their banking relationship with their bank for decades getting denied credit. These borrowers still need access to cash to run their businesses and turn to private lenders such as us to unlock equity in their properties. Real estate investors are continuing to acquire multifamily assets and reposition them to extract the most economic value; but liquidity is needed for these capital expenditures and the Fund is often a preferred financing source. With an increase in conventional mortgage rates, we are seeing price inelasticity in rates, meaning almost no borrower push back. In addition, our position in 1st position trust deeds continue to grow just adding extra layers of security to the Fund’s portfolio. We expect that we may even be able to increase our average rate into the 13% range over the next few months. Thank you to all of our partners in the Fund, many of you continue to divest out of equities and reinvest with Coastal.

PORTFOLIO HIGHLIGHT

All our trust deeds require that the funds be used for a business purpose. This borrower comes back again to upgrade his AirBNB Plus home in Malibu. He needed to get upgrades done asap before the busy, upcoming Holiday rental season! Our access to liquidity allowed the borrower to put in a new outdoor kitchen, upgrades to the backyard pool, spa & casita to enjoy the ocean views and new floors & paint throughout. We can’t wait to see the results of all the upgrades!

The owner needed the funds in a week to get contractors going and we came through! The goal is to increase the daily rental rate by $2,000 or more. Afterwards the broker on the deal told us that he brought the deal to us because he knew that Coastal Capital would fund in a week and once we said Yes there was a high certainty to close.

- SFR 5 BED / 6 BATH

- Malibu, CA

- Position: 2nd TD

- Rate: 12.50%

- CLTV: 47%

- Appraised Value: $11,000,000

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $25,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713