September 2022 Newsletter

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

MARKET UPDATE

It seems that California’s real estate market has swung back to a balanced market where buyers and sellers are actually negotiating over price a bit and contingencies. No longer are buyers being forced to come in with all cash offers above asking price to secure a property in the residential markets (not true for multifamily income properties that are still in incredible demand.). The crazy appreciation rates of single-family homes in the past bull run are coming back down to normal levels as well. We all knew that 10%+ annual increases in our home values wasn’t sustainable in the long run. We welcome the return to normalcy as it promotes a healthy, long-term market.

It is no secret that the driver of this cooling off is rising interest rates pushing up the cost of monthly mortgage payments. 30-year fixed mortgages are at a 14-year high Nationwide coming in at 6.29% up from 6.02% the previous week according to Freddie Mac, but still well below their long-term historical averages of 7.76%. Average buyer mortgage (excluding all refis) is $900 per month higher than a year ago crushing the lower end of the market (under $700K) that is hyper payment sensitive according to Realtor.com. Here in California with an average price home value of $860,000 we don’t really have much a lower end market since only the affluent can afford to buy. As of August 2022, only 25% of Californians could qualify for an average mortgage.

Skimming recent headlines, you might think the housing market is crashing. We all know headlines sell newspapers (at least they used to) and now get lots of clicks. Now those headlines do carry weight in the rest of the Nation where some markets are seeing some price deprecation. The average median housing price in the US is up 7.7% from a year ago. Sales volume for homes priced under $750,000 fell 13% in August 2022, versus 2021; for homes above that the decline was just 3%. If we dive specifically into our California market, we see that:

- August sales pace was up 6.1% from July

- Median price was up 0.7% in just a month in August from July

- Most California local markets have less than a 2.5-months of inventory (4 to 6 months supply is considered normal)

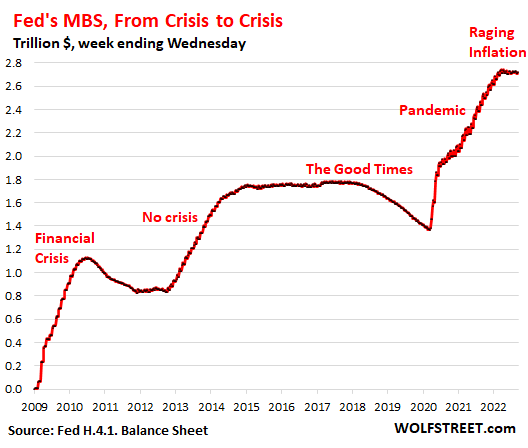

Now a headline that we are shocked didn’t make the headlines is that the Federal Reserve stopped buying Mortgage-Backed Securities (MBS) this month to fight inflation. The Fed used it as a tool in late 2008 to repress mortgage rates and inflate home prices as part of the cure for the Mortgage Crisis. From its infancy till April 2022 the Fed’s balance sheet ballooned to over $2.74 Trillion (a truly mind-boggling number) in MBS. For this reason, it would surprise us if rate are North of 7% by year’s end (keep in mind that the historic average of mortgage rates is 7.7%.)

Source: Wolfstreet.com

Specifically, to our Fund we are still experiencing incredible demand from long term residential income property owners. Landlords continue to get insane rents, especially throughout Southern California, anywhere near the Bay area and Tahoe region. Also starting to see an uptick in 1st position trust deeds flow across our application desk as landlords are scrambling to come up with cash to close fast on any and every multi-family property on the market.

Fix and flippers are exiting the market quickly and not taking on many new projects. The only deals we are seeing are slam dunks that are too good to pass up. Our small business owners are experiencing the squeeze from big banks that have tightened their guidelines for the self-employed. The fund continued to grow in the month with many of our current members exiting the stock market and choosing the safe haven our trust deeds.

PORTFOLIO HIGHLIGHT

This month’s highlight is from a landlord adding to his mini-rental empire. The borrower had the chance to scoop up another property in C if he could come up with the cash. We were able to get him $150,000 fast and now he has his fifth duplex in his portfolio after accessing the equity in this one. The good news is that he owns the new property free & clear and is planning for us to do a quick 1st position loan on it so he can get upgrades done ASAP and command higher rents!

The Fund has built its stellar reputation with brokers one deal at a time by following through on our offers (as long as no surprises come up title or escrow.) Being the one that gets it done pays off handsomely for all of us!

- SFR 3 BED / 2 BATH

- South Gate, CA

- Position: 2nd TD

- Rate: 12.50%

- CLTV: 65%

- Appraised Value: $1,000,000

Please visit our blog section of the website for the latest updates

and check out each loan origination.

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend to provide some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $25,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713