The 7 Most Important Real Estate Numbers for Investment Analysis

To succeed as a real estate investor, you NEED to be able to analyze potential investments. So, where should you start with an investment property analysis? What are the real estate numbers that you must be aware of? In this blog post, we’ll go over the 7 real estate numbers you need for analyzing investments.

There is a lot of real estate data that you’ll need to collect and analyze before making an investment. However, the following 7 are some of the most important:

1. Property Price

The first thing to think about is property price. You probably have a budget set, and even then, you’ll be on the hunt for a good deal that will save you money. Property price is also driving many other important metrics, such as fair market value and appreciation, as well as other important numbers in this blog.

2. Rental Income

The profit you earn from real estate investing will depend heavily on your rental income. As you likely know, gross rental income is simply the rent payments you receive from tenants. The time of payments is based on both the lease agreement and rental property type. Traditional long-term rentals earn rent on a monthly basis. Short-term rentals, such as for an Airbnb, usually mandates nightly or weekly payments. The amount will depend on the real estate market where the rental property is located, demand for rentals, the property type and strategy, rent control laws (if they apply), as well as general economic trends.

3. Price to Rent Ratio

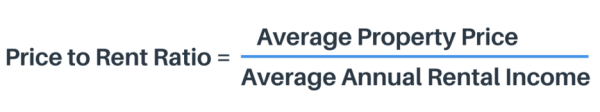

The next of the real estate numbers is price to rent ratio, also known as P/R. As you can tell from its name, this metric is calculated using the property price and rental income data:

The price to rent ratio indicates whether it’s more affordable to buy or rent property in a specific location:

- A low price to rent ratio (1 to 15) means it is more financially sound to buy a property than to rent one.

- When P/R is moderate (16 to 20), it is usually more affordable to rent a property rather than to purchase one.

- A high price to rent ratio (above 21) means it is much better to rent than to purchase a property.

The ranges are obviously relevant to the average resident of a housing market. They are, however, also significant to real estate investors. Areas with moderate to high price to rent ratios, for instance, will enjoy higher rental demand and are thus better places to invest in. At the same time, these markets do come with very high property prices and will make for great investment locations specifically for investors with deep pockets (or the ability to leverage real estate).

4. Rental Property Cash Flow

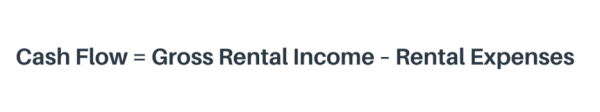

While rental income is a beneficial metric, it doesn’t give the full picture of rental property profitability. Gross rental income doesn’t, for example, take rental expenses into account. Luckily, there is a metric that does just that called cash flow. Here is how rental property cash flow is calculated:

As the difference between rental income and rental expenses (not operating expenses, which exclude financing costs), cash flow can be calculated on a weekly, monthly, or yearly basis.

5. Cap Rate

While rental property cash flow paints a more accurate picture of profit than rental income, it shouldn’t be used in isolation. The cash flow’s main limitation is that it does not showcase profit relative to the property’s price or value. To do that, we use what is known as return on investment (ROI) metrics. One of the most essential real estate numbers of this kind is the cap rate. Short for capitalization rate, it is calculated as:

The cap rate depends on two variables, as seen in the formula. First is the net operating income & the second is fair market value or the current value of an investment property for sale. The cap rate measures ROI regardless of property financing. As a result, this rental property ratio is an excellent way to quickly compare multiple properties during an investment property analysis.

6. Cash on Cash Return

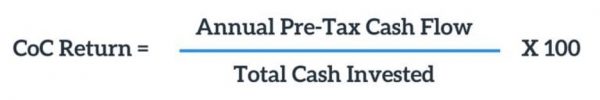

Similar to cap rate, cash-on-cash is also one of the most useful real estates that represent ROI. The main difference between the two is that the cash-on-cash return includes financing costs in its profitability estimation. It’s mainly used to measure the current performance of a rented property. Here’s how it is calculated:

The first number needed to calculate the cash-on-cash return is the annual pre-tax cash flow. Annual pre-tax cash flow is, as the name implies, yearly cash flow before taxes. It is the difference between the property’s net operating income and debt service. Debt service refers to financing costs, such as mortgage principal and interest payments. If debt service is set at zero, cash on cash return and cap rate will be the same value.

7. Airbnb Occupancy Rate

The last of the important real estate numbers is the Airbnb occupancy rate. This number is important if you’re looking to invest in short-term rentals. It is the ratio of the time a short-term rental property is occupied to the time it is available for rent. Airbnb occupancy rate depends on location, seasonal trends, and available nights.

While real estate prices are at record highs, many of Coastal Capital’s borrowers are successful real estate investor that are reporting great deals in the market that cash flow. Yes prices are high but rents are skyrocketing make the hefty price tag seem like a bargain in the long run To finance your first or fifteenth real estate investment property just give us a call: (310) 280-9173