June Latest Updates & Insights

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

MARKET UPDATE

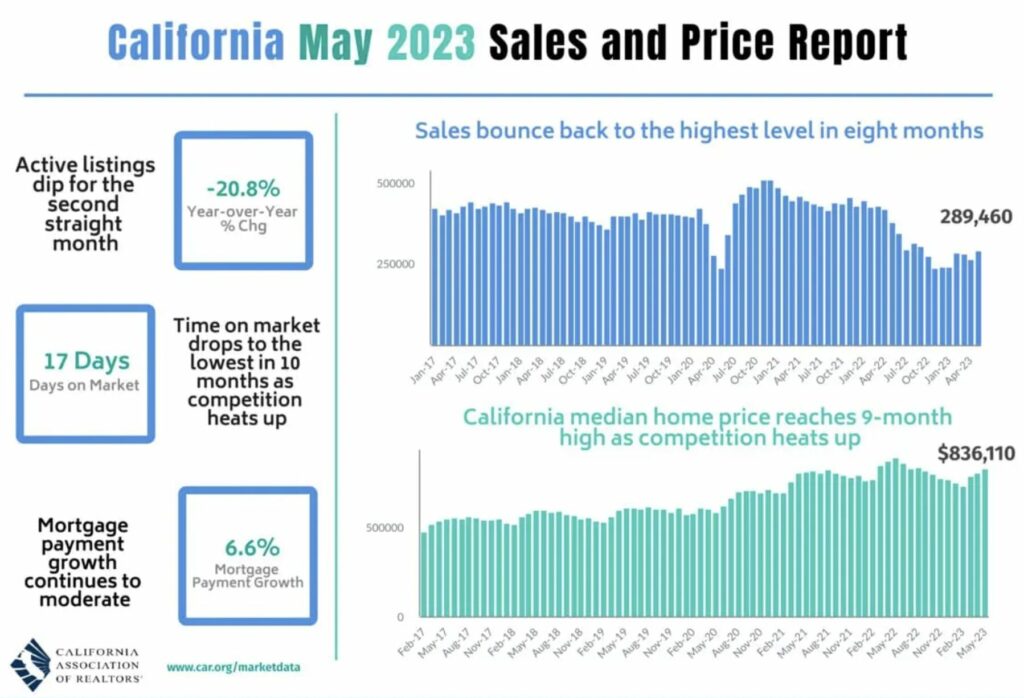

In May’s InSights newsletter we highlighted the ultra-low inventory of single-family residency & multi-family homes coming into the Spring selling season. Well, the California Association of Realtors released their May sales and home price numbers last week and just when you think it can’t go any lower, it does! The lack of inventory in virtually every California market from North to South, excluding San Francisco of course, is experiencing a severe lack of inventory. In the report, CAR’s C.A.R. Senior Vice President and Chief Economist Jordan Levine is quoted: “While home sales rose solidly in May, we don’t expect to see a rapid recovery because of the lock-in effect that’s keeping prospective sellers with low interest rate mortgages from listing their homes on the market and keeping inventory extremely tight.” Forty-nine out of 51 counties in California registered sales declines from a year ago in May with 36 dropping more than 20% from the same month a year ago. Other highlights:

Given that current low-interest mortgage borrowers have no interest in giving up their low payments (especially in these inflationary times) we fully expect these supply constraints to continue in both the short- & near-term. |

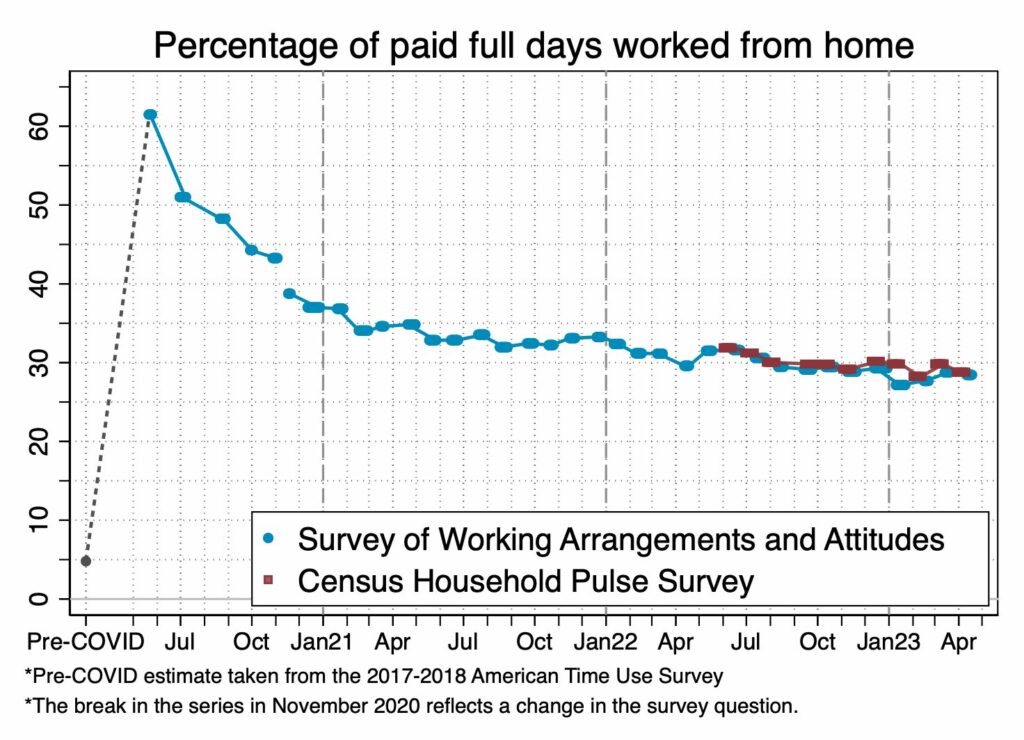

The commercial world of real estate is a completely different ball game. Work from home is devastating the commercial office space market. Demand for large office towers in major cities, have yet to rebound as work from home trends turn into the market standard. According to a recent paper by the National Bureau of Economic Research, attendance in the 10 largest business districts in the US is still below 50% of its pre-COVID level, as white-collar employees spend an estimated 28% of their workdays at home.

The national average is 19%, including Los Angeles at 26%, NYC at 23%, and Miami at 16% for vacancy rates. As demand has dropped, equity and debt investors have been trying to identify the current value of these properties. An office building in San Francisco owned by MUFG, was previously valued at $300 million is now on the market with just a quarter occupancy rate for an 80% discount! Two buildings in Midtown Manhattan sold for 50% of their asking price last week.

That being said other segments of commercial real estate, such as industrial, retail, hotels are performing pretty well. These segments are usually much smaller properties and well within our credit box and lending limits. This just reiterates that one has to research and know the market (location), the sub-market (commercial, residential, land, etc.) and then drill down even further into the sub-market categories (office, light industrial, retail, etc.) |

PORTFOLIO HIGHLIGHT

In 2023 we have not seen many fix-n-flips deals due bidding wars with homebuyers driving up acquisition cost. This higher cost eats into the profit margin of the flip leaving not enough margin for most flippers to take on risks from potential cost overruns. Our borrower needed just a few bucks to put the finishing touches on the property that he’s been working on for the past six months to get it to market. He knew that this unique two-bedroom property needed tons of curb appeal for a couple with no kids to fall in love with his flip. |

- SFR 2 BED / 1 BATH

- Whittier, CA

- Position: 2nd TD

- Rate: 12.99%

- CLTV: 64%

- Appraised Value: $960,000

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $250,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713