Coastal Capital – December 2023 Latest Updates & InSights

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

MARKET UPDATE

The median sale price for existing single family residence homes is up 3.4% year-over-year as of October, according to the Fed. The average rate on the 30-year fixed mortgage had dropped to nearly 7% at the end of August, but then began rising sharply, jumping over 8% by mid-October. Rates have since retreated somewhat. This past week, well qualified buyers can get a low-7% rate again which has boosted mortgage application rates.

As we close the books on November another month has passed. Another month of higher home prices coupled with a lower number of homes selling! The number of existing home sales in October by volume was down 14.6% lower than they were a year earlier. We expect November’s numbers when released will reflect similarly. Last month, Lawrence Yun, the National Association of Realtor’s chief economist was quoted saying “Prospective home buyers experienced another difficult month due to the persistent lack of housing inventory and the highest mortgage rates in a generation.” We expect the current trend of modest appreciation in most California real estate markets to continue being fueled by low inventory levels.

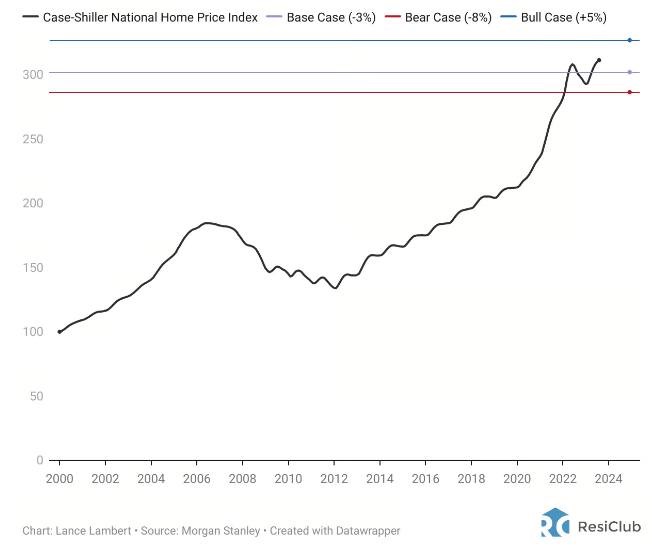

Morgan Stanley analysts recently sent out a new 59-page report to investors, detailing their views on the U.S. economy, housing market, and bond market in 2024. Morgan Stanley analysts believe that the U.S. economy will avoid a recession, incomes will continue to rise, mortgage rates will decrease slightly, and U.S. housing activity will pick up a little.

Source: Morgan Stanley

Most other housing analysts still expect U.S. house prices to rise a modest single-digit amount in 2024. This includes forecasts by:

- Mortgage Bankers Association: +4.1%

- Fannie Mae: +2.4%

- Wells Fargo: +2.5%

- Goldman Sachs: +0.6%

- AEI Housing Center: +4.0%

- CoreLogic: +2.6%

- Zillow: 0.0%

With all the experts forecasting in such a narrow range, we agree that most markets will hold steady and desirable areas will see normal appreciation of a few percentage points for most areas in California. Our core markets of Los Angeles, Orange and San Diego counties may see more elevated appreciation rates.

Multifamily, the largest pool of assets securing our trust deeds, is holding strong and continues to perform well. Although rent growth has slowed, the vacancy rate has remained roughly 5% throughout 2023. Current interest rates will likely keep mortgage rates up near or above 7%, continuing to price out would-be homebuyers and sustaining the multifamily rental market demand. The only notable concern is the lack of demand for luxury apartments. They may be easy to build, but they’re not necessarily easy to occupy. As a result, many high-end apartments have reduced rents and offered concessions to attract residents. The good news is that these large, luxury developments are usually 70-units or more and Coastal Capital is not a viable financing partner due to the needed financing amount.

Commercial real estate trends continue to be a mixed bag across market segments. The office building vacancy rate reached 19.2% in Q3 according to Moody’s Analytics. That’s up from Q2 and approaching the historic peak of 19.3%. Despite these headwinds for office, it’s important to remember that while there is and will continue to be obsolete office, the office is not obsolete. Older, less-desirable Class B and C offices may face obsolescence, but Class A is booming. Employers, especially tech, are realizing that they must upgrade to attract workers to return to office. Many are going with downsizing from Class B and paying more per square foot for newer offices but a less total monthly lease cost.

Industrial continues to perform well, especially cold-storage properties, but the signs of softening are starting to show. The asset class may be moderating as the post-pandemic demand for more inventory decreases and renters hold off on expansion due to uncertainty of how rising interest rates will affect their business. One highlight we are hearing in this market segment is re-shoring and nearshoring efforts are gaining traction in manufacturing and may provide a further boost for the sector.

Retail remains strong considering 85% of all shopping is still done at the retail locations. The American Dream is still alive and well throughout California. New entrepreneurs are constantly trying new restaurant menus, peddling innovative gadgets, and testing new ways to bring value with unique services. Unless a major recession hit (which is not currently in the forecast) we expect to see slow and steady growth in this segment.

With national and regional banks tight credit standards the demand for the Fund’s short-term, business-purpose financing product continues to be in high demand. If our pool of capital was even five-fold larger we would have no issues in deploying capital into high-quality deals. Small business owners continue to request financing to grow their businesses, launch new locations or smooth out a cashflow issue. Landlords continue to access the equity built up in their properties to complete renovations on existing properties to raise rents and increase cashflow from their units in the long term. We expect both drivers of demand for our trust deeds to persist in the short-, medium- and long-term horizons.

Thank you to all our existing partners who have been referring over friends & family to join us. Please note that our initial minimum investment is $100,000; however existing partners in the Fund can add on in any amount of $2,500 or more.

PORTFOLIO HIGHLIGHT

A third-generation business owner with near perfect credit needed a quick infusion of cash to seize an opportunity. Yes, he could have gone to the bank but without a credit line in place it was going to take a week, or two & he needed funds in less than a week or else lose out on the deal. His broker knew who to call to get him fast cash.

With a low, loan-to-value ratio and a home that beams with pride this was an easy underwrite. Thanks to an organized and responsive borrower we got the deal done in four days! We think we’ll see some more business from the broker soon.

- SFR 5 BED / 4 BATH

- Fullerton, CA

- Position: 2nd TD

- Rate: 12.99%

- CLTV: 45%

- Appraised Value: $1,700,000

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $250,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713