January Latest Updates & Insights

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

MARKET UPDATE

Charging into 2023 we didn’t expect conventional mortgage rates to settle and now we’re back in the low-6% range. This seems to have given some relief in the single-family residence market and spurred a few homebuyers. With the Federal Reserve still poised to raise rates later this week 0.25% this is possibly setting up to be just a temporary reprieve. The Mortgage Bankers Association index for new mortgage applications made big gains during the month. Refinance applications to conventional lenders were up over 15% the second half of the month as compared to the second week of January. Although not an apples-to-apples comparison, here at Coastal Capital we also experienced incredible application volume from our brokers for our business purpose trust deeds.

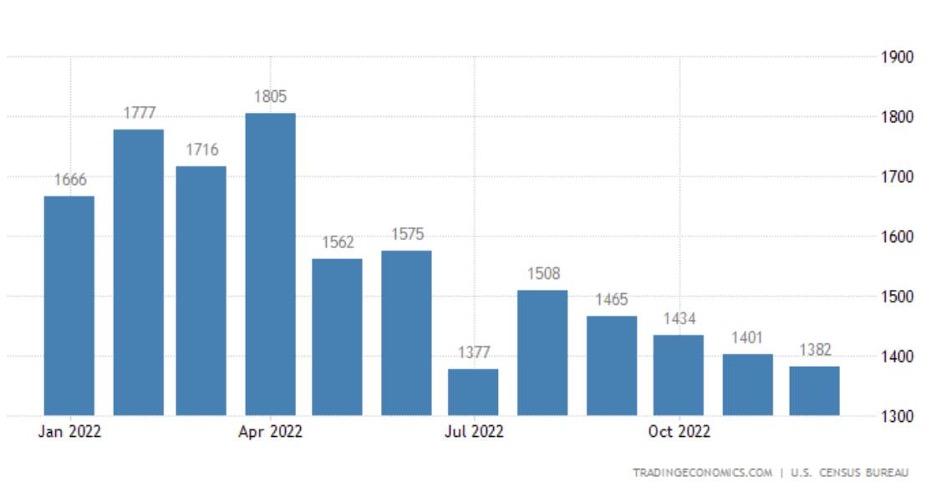

The California market still has the same issue for both the residential and multi-family markets: Supply! Current owners still have little interest in moving and graduating up to an interest rate that is almost double last years (80% of them locked in at 3.5% or less.) Now to exasperate matters, new builders are delaying new projects as the cost and availability of raw materials is highly questionable. Construction on new U.S. homes fell a seasonally adjusted 1.4% in December to 1.38 million, the Commerce Department said last Thursday. The drop in construction on homes followed the decline in November, when housing starts also fell by 1.8%. In fact, housing starts are at the lowest level since July 2022. The annual rate of total housing starts fell from 21.8% from the previous year. The chart below from the US Commerce Department while not to scale highlights the drop off.

Source: US New Housing Starts in Units, Trading Economics

Another story that hasn’t changed is sky high residential rents. For the residential markets in California the home affordability index that was already at historic lows keeps getting worse. With limited housing supply outlined above we don’t see this trend changing anytime soon. The average rent for a 3 bedroom single family home in Los Angeles has now eclipsed $5,000 per month. Soon the cost of renting will spur non-homeowners to settle on a property and purchase it to reap the tax advantages of paying mortgage interest.

Rentometer’s 4th Quarter 2022 data is returning some mind boggling numbers. In just one year San Diego’s average rent has gone from $3,800 to just over $4,500 per month. Our landlord borrowers are utilizing the equity in their properties to rehab old properties to capture this increase in cashflow. This is also driving up property values of multi-family properties. Many of our long-term landlords are aggressively upgrading their portfolios of properties to larger buildings with more units.

Source: Rentometer.com

Just like last month these landlords continue to make up a majority of our application volume, especially in Los Angeles, Orange and San Diego counties. Meanwhile, the industrial market continues to experience a steady state with supply and demand levels are at historic norms. We only see a few applications for this segment as the financing requests skew to $1M-plus. Generally, the deals are solid with very low LTVs and we welcome any brokers who want to partner with us. The commercial market continues to be a mixed bag. Kidder Mathews market research reporting that in the 4th Quarter rental rates are trending up and vacancies are trending down as workers slowly return to the office.

Big banks are locking down their vaults to mitigate risk and prepare for a possible recession. It is becoming increasingly difficult for borrowers to qualify for financing. This is especially true for those who are self-employed, own their own business or have less than perfect credit. This means that many existing borrowers are having difficulty refinancing to pay off existing liens or pull cash out on a refi. The availability issues of conventional financing is pushing up rates for trust deeds as well. Across the market in California for private mortgages and trust deeds we are seeing elasticity in rates that borrowers are willing to accept.

Thank you for all our existing partners who have been referring over friends & family to join us. Please contact Scott Griest at Scott@CoastalCapital.com if you would like to add to your investment.

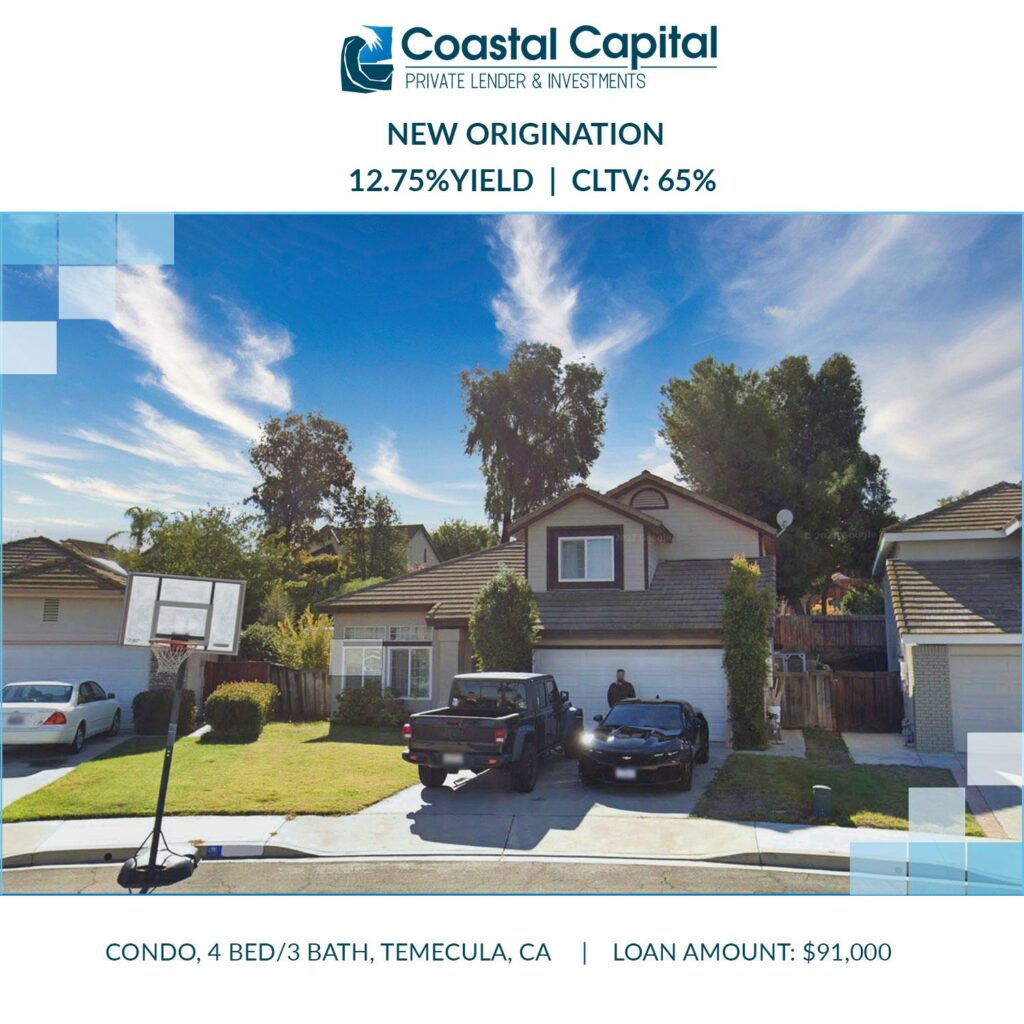

PORTFOLIO HIGHLIGHT

Another small business owner needed to access the equity in his home fast! The family had the opportunity to buy inventory from a competitor going out of business. The request for financing was $150,000 but we were not comfortable pushing the loan-to-value that high on this property. This situation occurs quite often when borrowers think their property’s value is sky high. Thanks to the tireless efforts of a great broker all parties got to a deal that everyone was comfortable with. After four days of back-and-forth Coastal Capital were able to close in a week. Can’t wait to do more deals with this professional brokerage group. They made a hard-to-get-done deal look easy! |

- Condo 4 BED / 3 BATH

- Temecula, CA

- Position: 2nd TD

- Rate: 12.75%

- CLTV: 65%

- Appraised Value: $678,000

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $25,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713