September 2023 Latest Updates & InSights

COASTAL CAPITAL INSIGHTS

Each month Coastal Capital strives to bring you the latest updates and insights into the California real estate market for both investors and brokers. We always welcome new investors who enjoy above-average returns that are not correlated to the equity markets. As always, we appreciate both new investor and broker referrals, as the network builds it brings more value to all through diversification.

Please note that you can add on to your existing investment in any amount. While an initial investment requires an investment of $100,000; existing partners in the Fund can add on in any amount from $2,500 or more.

MARKET UPDATE

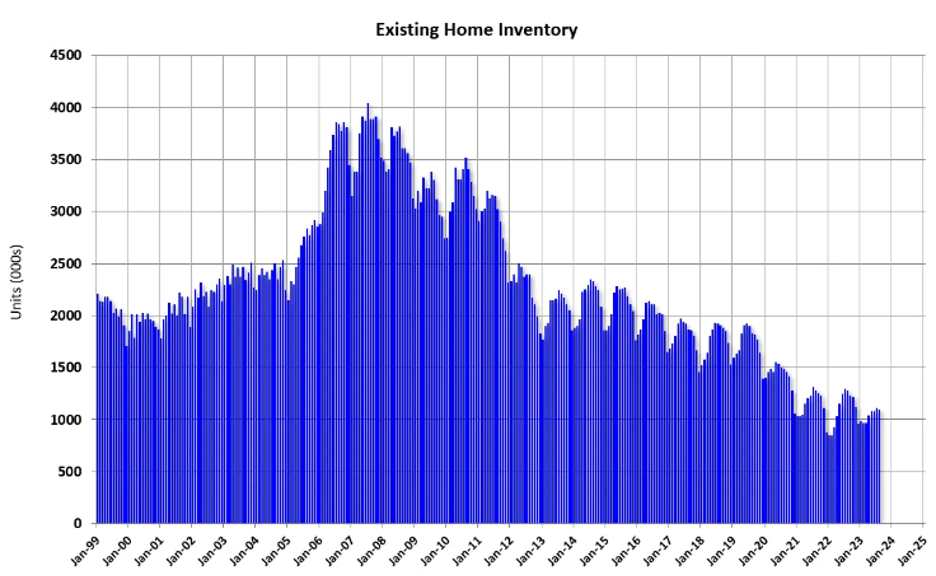

SFR Supply Continues To Dwindle

We are starting to sound like a broken record and the chart below shows why. Just when you think the housing inventory shortage can’t get worse, it does! The Association of Realtors just released their August numbers. Overall, in the US inventory levels are down yet again year-over-year (YoY) Nationwide. This has been occurring every year since 2008. Now, in 2023 the number of homes for sale is just 25% of what was available in 2007 & 2008. In the West it is even worse, existing-home sales volume (not prices) slumped 2.6% from the previous month and in August inventory levels are down 15.7% from the prior year.

Of course, with less supply and steady demand there is only one direction prices are going to move; and that is up. In the West for August the median price of a single-family residence came in at $609,300, up 1.0% in a year. For California that number hit almost $860,000 up 5% from August 2022! Other data points are confirming the same with Black King Capital reporting that prices were up 2.3% YoY in July hitting all-time highs. Even Freddie Mac is reporting prices were up in July by 2.9% YoY building on a June increase of 1.6%.

With mortgage rates surpassing 7% for the first time in over two decades and expected to stay elevated in the coming months we expect the supply issues to continue in both the short- and mid-term. Pending sales, in fact, declined nearly 25% in August, which suggests that closed sales in California will likely slip again in September before possibly bouncing back in October.

Source: Association of Realtors

In the World of commercial real estate office space sees a longer recovery, multifamily is still in high demand and retail continues to rebound. The most recent Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey, released earlier this year, shows a mixed bag of outlooks that vary based on the type of real estate offered. The findings come as the commercial real estate industry continues to navigate rising interest rates, declining valuations, and economic uncertainty, leading to a contraction in new commercial development across most asset classes. However, there are several signs of light at the end of the tunnel.

The biannual survey polls a panel of California’s real estate professionals to project a three-year ahead outlook for commercial real estate and the macroeconomic trends impacting industry participants across the multifamily, office, retail, and industrial markets. The latest survey finds that 29% of Southern California panelists and 20% of Northern California panelists are planning new office developments this year, compared to 48% and 50% in 2022, respectively, when demand was expected to grow alongside supply. However, those expectations did not materialize according to the latest survey, as 2022’s high interest rate environment impacted office market fundamentals.

While industrial remains a strong performer in the commercial real estate industry, the latest survey predicts that demand will remain strong but not increase at the elevated rates of the past two years. We will continue to actively solicit brokers for trust deeds secured by industrial properties as we expect good appreciation in this segment through the long-term horizon.

Retail remains steadfast on the comeback trail. Following a period of headwinds caused by the pandemic and consumer reliance on e-commerce the signs of recovery in the retail market come down to three key factors that are creating optimism for the sector:

• New housing developments are driving demand for nearby retail options

• Return to the office, albeit limited, and a growth in tourism leading to retail demand in metropolitan areas

• The reconfiguration of existing retail establishments adapting to open-air, post-COVID concepts, is attracting new shoppers/customers

Demand of the Fund’s trust deed product offering continues to be extremely strong these past few months big banks & smaller regional banks still have their vaults doors shut to all but prime small-business owners. The lack of traditional financing for them is driving a ton of application flow. Borrowers who are landlords are still snatching up available multi-family properties as soon as they come on the market. With rental rates for housing staying elevated and expected to continue slowly climbing we don’t see this trend ending anytime soon. We do see our existing borrowers struggling to secure new financing. This has led to an uptick in delinquencies and notice of foreclosures being sent out. Thanks to this we expect returns in the fund to also increase as incremental revenue from default interest goes up. We may also get the opportunity to foreclose on a few properties which usually provides tremendous returns & dramatically increases the Fund’s share value.

Thank you for all our existing partners who have been referring over friends & family to join us. Please note that our initial minimum investment is $100,000; however existing partners in the Fund can add on in any amount of $2,500 or more.

PORTFOLIO HIGHLIGHT

Owner of a Southern California awning company needed some capital to purchase wholesale product at a steep discount. His first stop was his local, regional bank. Of course, they turned him down without perfect credit. The then turned to a broker in San Diego who had assisted before His broker’s challenge was finding a partner that would take the time to evaluate and fund a $60,000 deal.

Given the strong equity position in the property we were happy to assist. The process was easy for both the broker and business owner, especially since the loan-to-value ratio was in the low-50 percentile. With such a nice home that showed pride of ownership Coastal Capital was able to close in just four days, highlighting that certainty to close combined with speed often wins us great business.

- SFR 3 BED / 2 BATH

- Mission Hills, CA

- Position: 2nd TD

- Rate: 13.99%

- CLTV: 53%

- Appraised Value: $810,000

Looking for a way to get more from your retirement savings? A self-directed IRA (SDIRA) could be the answer. We constantly get asked on how to set this up and asked the firm we recommend providing some insight with our investors:

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is quite simply, an IRA. All IRAs abide by the same laws and possess the same capabilities. Unlike other IRAs held at banks, brokerage firms and other institutions, with a SDIRA, you’re not limited to stocks, bonds, or mutual funds.

What are the benefits?

A SDIRA gives you the opportunity to build a more diversified and resilient portfolio. It allows you to take advantage of alternative investments such as real estate, precious metals, private equity, notes, and more. A custodian/administrator is required to do the record keeping for the assets in your account, but nothing moves in or out of it without your direction. You decide how much, when, and most of all, what to invest in, giving you the freedom to invest in what you know best.

Investing in Real EstateWith a Self-Directed IRA

Real Estate is a popular investment among SDIRA holders because it is a tangible asset that people know and trust. With a SDIRA, you can invest in a wide range of real estate assets: residential or commercial properties, developed or undeveloped land, condos, hotels, mortgage notes, and more. Depending on what type of account you choose, earnings can continue to be either tax-free or tax-deferred.

The level of control and flexibility associated with a SDIRA does come with its own set of responsibilities. For example, investments made with your SDIRA are owned by your SDIRA, not by you personally, making self-dealing prohibited. Click here for more information on SDIRA rules.

Getting Started

The first step is to decide what type of account you want to open. Then, establish how you’ll fund it. Make sure to consult with a legal and/or tax advisor before you begin can help you to answer these questions. If a SDIRA sounds like it could be the answer to your retirement questions, get your copy of the Self-Directed IRAs Basics Guide.

Brokers Always Welcome

Coastal Capital is always looking for referrals from brokers and open to new investors in the fund. Please share this email or connect us directly.

Asset Based Loans on Business Purpose Real Estate

- Loan Amounts: $250,000 to $500,000

Exceptions required for larger amounts - Origination Fees: 1 to 3 points with a minimum of $2,000

- Serving Location: State of California Only

- Purpose: Business or Investment Purpose Only

- Types: SFR, Multifamily, SFR Additions, Fix & Flip, Light Commercial & Retail, Land.

- Fix Loan Term: 6 months to 18 months

- Rates: from 10% up to 15%

- Loan to Value: 65% without exceptions, higher available

- Loan to Cost: Up to 80% with hold back for exceptions

- No minimum credit score. Low FICO credit score okay

HOW TO REACH THE TEAM AT COASTAL CAPITAL

Chris Tomasewski

Chris@CoastalCapital.com

310-529-5678

Scott Griest

Scott@CoastalCapital.com

310-529-9975

Chio Baldocchi

Chio@CoastalCapital.com

310-280-7223

Phil Guertin

Phil@CoastalCapital.com

949-378-2713